Non-mandatory statutory compliance for startups in Malaysia

Getting started with the journey in entrepreneurship involves learning a whole set of skills, from financial planning, brainstorming marketing strategies and people management, to dealing with laws and regulations that a company needs to follow. While it is convenient to engage with company secretaries and accountants to sort things out, knowing the requirements and exceptions a startup has towards statutory compliance helps set expectations right when looking for help from professionals.

The Companies Act 1965

The Companies Act 1965 was the first law established to regulate starting and running a company in Malaysia. As the Companies Act 1965 has been replaced with the Companies Act 2016, there are several key updates that simplify the statutory compliance that a company has to follow. This is applicable to private limited companies incorporated after the Companies Act 2016 came into effect. These are some examples of compliance a company no longer has to adhere to:

Memorandum and Articles of Association (M&A)

In the past, M&A was outlined to establish the constitution of how the company is governed, such as responsibilities of directors, allotment of shares, etc. The Companies Act 2016 today can be used as a constitution without having to establish a separate M&A unless there is a need to specify more rules and regulations in managing the company. It is still recommended to adopt a constitution under certain situations.

Common seal

The common seal is an impression on melted wax or an indentation on an official document that deems the document officially executed. According to the Companies Act 2016, only signatures of 2 authorised persons are needed where 1 of them should be the director for the execution of documents. In the case where there is only 1 director in the company, signatures of the director and 1 witness are required. Hence, a common seal is no longer needed for newly registered companies.

Annual General Meeting (AGM)

AGMs are held annually between the directors and shareholders of a company to analyse the company’s performance and to plan business strategies for the following year. It is no longer mandatory for private limited companies in Malaysia to hold an AGM each year as directors and shareholders of the company can now make decisions by signing a circular resolution with or without holding a physical meeting.

Sales and Service Taxes (SST)

If your business provides taxable goods or services to customers, you may wonder when you should start collecting Sales and Service Taxes (SST) from the customers. You only need to register for SST if your annual sale value exceeds RM500,000 in 12 months.

Audited financial statement

Each year, your company secretary files the annual returns and financial statements of your company to the SSM. You can provide an unaudited financial statement if your company falls under one of the following categories:

Dormant companies

Companies that have no transaction since they have been incorporated.

Zero-revenues companies

Companies with no revenue for the current and past 2 financial years, with total asset of less than RM300,000.

Threshold-qualified companies

Companies with less than RM100,000 revenue, with a total asset of less than RM300,000, and the number of employees of less than 5, for the current and past 2 financial years.

A company secretary is the best advisor who can provide advice related to the laws and regulations that a company needs to follow, as well as get you in touch with relevant professionals to provide necessary services. Entrepreneurship is challenging; so don’t let statutory compliance of your company becomes an obstacle to growing your business. Appoint a company secretary who is ready to assist you in making the right decisions when it comes to statutory compliance.

Table of Contents

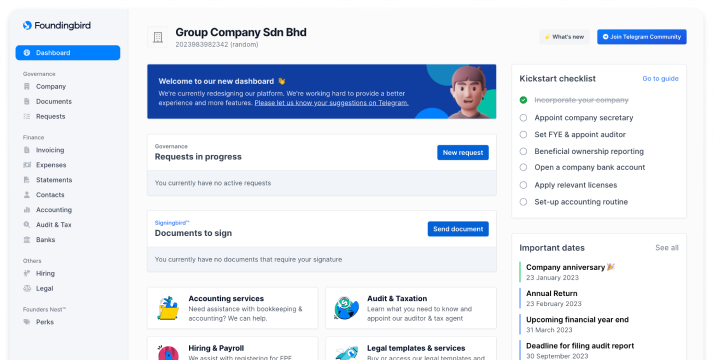

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →