8 main roles of a company secretary in Malaysia

If you have no experience in starting a company, you may be wondering the purposes of paying a monthly fee to an appointed company secretary for your Sdn Bhd. Even though it is a statutory requirement as stated in the Companies Act 2016 for all companies to appoint a company secretary, the company secretary does not seem to do much in contributing to the operation of the company. However, the company secretary is an officer of the company which is not merely administrative but also advisory in nature, especially in corporate governance matters and boardroom procedures. These are the 8 main roles of a company secretary that helps you with your company’s legal compliance.

Advise on the registration and governance of the company

Although you can incorporate your Sdn Bhd through the MyCoID portal on your own, engaging with an experienced company secretary can save you the hassle of deciding on an available company name and preparing the information needed, ensuring a smooth company registration process. A digital company secretarial firm even allows you to register your Sdn Bhd fully online without having to meet up with a company secretary or visit the SSM counter. A company secretary not only helps you with starting a company, but they also provide advice on corporate restructuring, mergers, acquisitions, good corporate governance, and procedures of striking off or winding up a company.Ensure the company is compliant with laws and regulations

The key updates of the Companies Act 2016 simplified compliance with the governance of a Sdn Bhd. However, it is not the only law a Sdn Bhd needs to follow. Nevertheless, a company secretary needs to be appointed within 30 days from your company incorporation date. There are other legal requirements that that should be fulfilled at all times such as taxes, business licenses, employer’s EPF, SOCSO, and EIS contribution, the employment law, etc. A company secretary can advise and get you in touch with relevant professionals to provide the necessary services. You can turn to your company secretary regarding any business-related laws and regulations that you are unsure of.Document meeting minutes and resolutions

Although Annual General Meetings (AGMs) are no longer required for Sdn Bhd, a company secretary is required to attend Board Meeting (meetings of directors) and General Meetings (meetings of shareholders) as requested and prepare the agenda of the meeting and to ensure that the meetings are properly called, constituted and carried out in accordance with the law of meeting. The company secretary prepares the minutes of meetings and also follows up on any decision made during the meeting as instructed. Sometimes, extracts of resolutions that are decisions taken at meetings are prepared and certified as a true extract of the original meeting. If the board decides that a written resolution is sufficient, the company secretary prepares and distributes circular resolutions to the directors to be signed. A written resolution signed off by the directors is considered to be sufficient evidence of the passing of a company decision.Ensure company details are up to date

Company details such as directors, shareholders, paid-up capital, shares, and constitution could change from time to time as the company grows. A company secretary is responsible for notifying the SSM of such changes and update all related company documents that are kept in the registered office. Other documents such as the constitution, minute books, financial statements, meeting minutes, resolutions are also managed and kept at the registered office by the company secretary. Additionally, a company secretary certifies documents as true copies of the originals (CTCs) that are needed for opening a business bank account, loan application, and other official matters.Record the Financial Year End (FYE)

Financial Year End is the date when the company closes the financial accounts. It is usually the last day of a particular month you have decided. You should inform your company secretary of the FYE decided for your company as early as possible.Appoint auditor

Unlike accountants and lawyers, an auditor has to be appointed by providing consent to act before they can provide auditing services to the company. Each year after the FYE, there will be 30 days of vacant period when a new auditor can be appointed. If there is no new auditor appointed during the vacant period, the previous auditor will automatically be appointed for the next financial year. However, if you wish to appoint a new auditor outside the vacant period, the resignation of the existing auditor has to be lodged to the SSM and new auditor can be appointed after the existing auditor provides clearance to the company. However, you don’t have to appoint an auditor if your company falls under one of the following categories:- Dormant companies

- Zero-revenues companies

- Threshold-qualified companies

Verify the identity of directors and shareholders and lodge the declaration of beneficial ownership

Identity verification, or more commonly known as the Know Your Customer (KYC), is an important process for the company secretary in ensuring that all directors and shareholders of the company are who they claim to be. It can be done by meeting the directors and shareholders face to face or through e-KYC, before the company is incorporated or when a new director or shareholder is added to the company. Besides, the company secretary will obtain and maintain the records of the declaration of beneficial ownership upon receiving the information from directors and shareholders.

Lodge annual reports required by SSM

The SSM requires Sdn Bhd to lodge several mandatory reports each year - an annual return and audited financial statements together with directors’ reports. There are penalties for the company or the directors for failing to adhere to this requirement as stated in the Companies Act 2016. A company secretary ensures strict compliance with these datelines.

Annual return

An annual return is a summary of the company with information such as business nature, registered address, directors and shareholders, etc. Even if there are no changes in this information after a year of operating the Sdn Bhd, a statement still has to be lodged to confirm that there are no changes made. The annual return is prepared on the anniversary of the company incorporation date and should be lodged within 30 days thereof.

Financial statements with directors’ report

Financial statements are usually prepared by the accountants before being audited by a certified auditor. The auditor will prepare an auditor's report while the directors will prepare the director's report which explains information on the directors, main activities of the company, shares, dividends, business reviews, etc. These documents are then compiled and signed by the commissioner for oaths before being passed to the company secretary for circulation to shareholders and the auditor. Once it is approved by the board, it will be lodged to the SSM within 30 days after the circulation.

“[Company secretaries’] value and worth have to be redefined and due recognition is given to them for the enhanced profile they now have to assume,” said Kulwant Kaur, technical director of MAICSA back in the year 2003. Not everyone can act as a company secretary. Besides fulfilling the requirement as stated under Section 235 of the Companies Act 2016, a company secretary needs to obtain a practising certificate that should be renewed every 3 years. Company secretaries are just like accountants, lawyers, and other professionals that provide essential services to assist your Sdn Bhd so that you can leave the important but time-consuming tasks to them and focus on your business. Hence, don’t hesitate to ask your company secretary for advice if needed.

Table of Contents

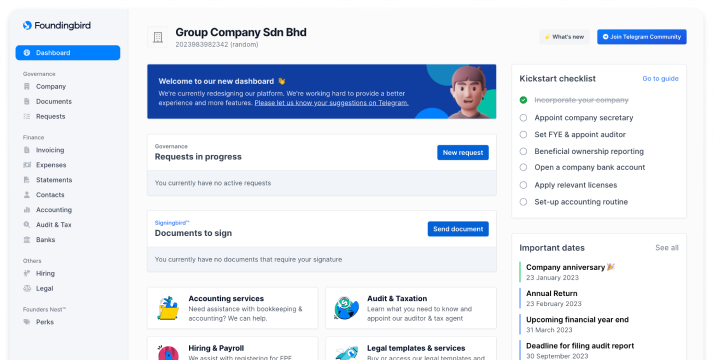

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →