10 questions about SST in Malaysia answered for SMEs

What is SST?

Implemented since September 2018, Sales and Service Tax (SST) has replaced Goods and Services Tax (GST) in Malaysia. The SST consists of 2 elements:

- Sales tax, a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer, and on taxable goods imported into Malaysia.

- Service tax, a consumption tax levied and charged on any taxable services provided in Malaysia by a registered service provider in carrying out their business.

What are taxable goods and services?

Bear in mind that the following listed taxable goods and services are not applicable for goods and services providers under the special areas in Malaysia (including Langkawi Island, Tioman Island, and Labuan Federal Territory).

Taxable goods

Taxable goods refer to all goods manufactured in or imported into Malaysia as stated in the Sales Tax (Goods Exempted from Tax) Order 2018, Sales Tax (Exemption from Registration) Order 2018, and Sales Tax (Persons Exempted from Payment of Tax) Order 2018. The complete list can be found on the SST Orders page of the MySST website. However, there are some goods exempted from Sales Tax, such as:

- Live animals, fish, seafood and certain essential food items including meat, milk, eggs, vegetables, fruits, bread, etc.

- Books, magazines, newspapers, journals, periodicals, etc.

- Pharmaceutical products such as medicine, medical cream, cough syrup, etc.

- All goods manufactured for export

- Manufacturing activities such as tailoring, installation of goods into a building; also those conducted by jewellers, opticians, etc.

Taxable services

Taxable services are any services listed in the First Schedule of the Service Tax Regulations 2018, which are divided into Groups A to I. Digital service tax that is charged upon foreign digital service providers that came into effect on the 1st of January 2020 falls under Group I.

- Group A – Accommodation

- Group B – Food and beverage

- Group C – Night clubs, dance halls, carabets, health and wellness centres, massage parlours, public houses, and beer houses

- Group D – Private club

- Group E – Golf club and golf driving range

- Group F – Betting and gaming

- Group G – Professionals

- Group H – Credit card and charge card

- Group I – Other service providers

There are some services exempted from Service Tax as well. Some services under Groups G and I are exempted for businesses in which both service providers and service users are SST registered and fall under the same Group. For example, a law firm that is SST registered receives accounting services from an accounting firm which is also SST registered. The accounting services received by the law firm is exempted from the SST.

Who is a taxable person?

A taxable person is a manufacturer or a service provider who is registered or liable to register for SST. However, any businesses that are not liable to register or are exempted from the SST registration may apply voluntarily to the Director General (DG) of Customs to register for SST.

Is my business liable to register for SST?

To be liable to register for SST, there are a few criteria to be met by businesses:

Sales tax

- Your business is in the manufacturing industry for taxable goods.

- The total sales value of taxable goods in the past 12 months exceeds RM500,000.

Service tax

- Your business is a service provider of taxable services.

- The total value of your taxable services in the past 12 months exceeds the registration threshold which is usually RM500,000, with the following exceptions:

| Taxable service provider | Threshold |

|---|---|

| Operators of restaurants, bars, snack-bars, canteen, coffee house or any place providing food and drinks whether eat-in or take-away | RM1,500,000 |

| Persons who are regulated by Bank Negara Malaysia and provide credit card or charge card services | No threshold |

| Approved customs agents | No threshold |

What are the SST rates?

SST is an ad-valorem tax that is calculated through percentage, in proportion to the estimated value of the sales or services.

Sales Tax

- 5% for fruit juices, basic foodstuffs, building materials, personal computers, telephone, and watches.

- 10% for all other goods, except petroleum subject to specific rates and goods not specifically exempted.

Service Tax

- 6% for all taxable services except for the provision of charge or credit card services which is RM25 per year on each principal or supplementary card.

How to register for SST?

If your business is liable to register for SST, you may complete the Sales Tax registration or Service Tax registration respectively online on the MySST website. The due date for registration will be the last day of the month following the month in which the total sales value has exceeded or is expected to exceed the threshold.

This is an example:

- 29 February 2020 – Total sales value of taxable goods or services exceed the threshold

- 31 March 2020 – Last day to apply for registration

- 1 April 2020 – Effective date of registration

If your business is exempted from Sales Tax under Sales Tax (Persons Exempted from Payment of Tax) Order 2018, an application for exemption should be made through the MySST website as well.

When to file the SST return and make payment?

The taxable period of SST is a period of 2 calendar months. Hence, SST returns must be filed every 2 months even if there is no tax to be paid. The SST payment should be done within 30 days from the end of the taxable period.

The timing to account for the respective transactions is different for Sales Tax and Services Tax:

- For sales tax, it is when the taxable goods are sold, disposed of or first used by the taxable person.

- For service tax, it is when payment is received for the taxable services rendered. But if payment for the service is not received within 12 months from the date of invoice issuance, the tax is due on the day immediately after the expiry of the 12-month period.

Do note that the length of your first taxable period is determined based on whether your financial year-end month falls on an odd or even month.

How to file the SST return?

There are 2 ways to file the SST return:

- Do it online through the CJP system.

- Download the Form SST-02 from the MySST portal and mail it to the Customs Processing Centre (CPC) by post. The address is as follows: Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No.22 Jalan SS6/3, Kelana Jaya, 47301 Petaling Jaya, Selangor.

How to pay SST?

Similar to the filing of SST return, there are 2 ways to make the SST payment:

- Do it online through the FPX system of the CJP system. However, there is an allowable payment limit for online transactions, i.e. RM100 million for corporate bank account and RM100,000 for individual bank account. The remaining payment can be made by issuance of cheque or bank draft which may then be mailed to the CPC.

- Do it through cheque or bank draft made payable to ‘Ketua Pengarah Kastam Malaysia’ and mail it to the CPC.

What are the possible SST penalties?

Penalties will be imposed for the following offences:

Failure or late to register for SST

The business will be expected to pay the SST out of their own pocket for SST on time as the SST can no longer be collected from the customers.

Failure to file SST returns

Upon conviction of not filing SST returns, the taxable person can be fined a maximum of RM50,000, imprisoned for a maximum of 3 years, or both.

Failure to make SST payment

Upon conviction of not making SST payment, the taxable person can be fined for a maximum of RM50,000, imprisoned for a maximum of 3 years, or both. Do note that failure to make SST payment and failure to make SST returns are 2 separate and distinct offences.

Late payment penalty

Upon expiration of 1 month from the taxable period, 10% of charges are imposed on any outstanding SST for the first 30 days. Thereafter, for the second 30-day period, an additional 15% of charges are imposed on any outstanding SST and for the third 30-day period, an additional 15% of charges.

Evasion of tax

- For the first offence, the taxable person can be fined with a minimum of 10 times and a maximum of 20 times of the Sales Tax amount, imprisoned for a maximum of 5 years, or both.

- For the second offence, the taxable person can be fined with a minimum of 20 times and a maximum of 40 times of the Sales Tax amount, imprisoned for a maximum of 7 years, or both.

———

Special thanks to Wei Khee who helps out with the content of this article.

Table of Contents

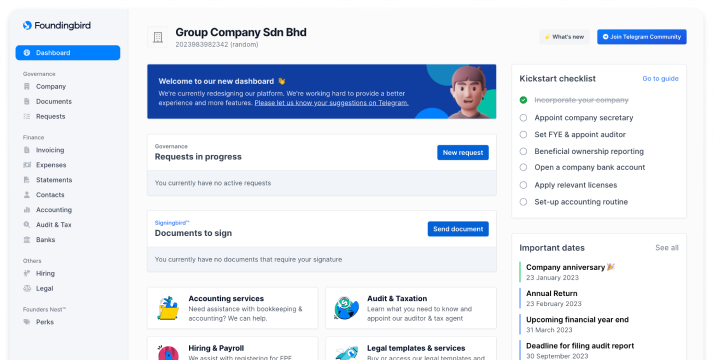

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll