The checklist of annual and monthly compliance for Sdn Bhd

Running your business under a Sdn Bhd business entity not only separates your personal liabilities from the business liabilities, but also opens up more opportunities to grow your business. Nonetheless, the governance of a Sdn Bhd requires compliance towards regulations from various governmental authorities to ensure that you are operating your business legally in Malaysia. Understanding the annual and monthly compliance for your Sdn Bhd helps you adhere to the regular compliance activities accordingly.

After your company is incorporated

Right after your Sdn Bhd is incorporated, there are several compliance activities to do in order to legally operate your business.

Business licence application

When to get it done: As soon as possible

Getting your company incorporated is just the first step in starting your business. Depending on the nature of your business, sometimes a business licence is required to run your business. There are generally 2 types of licensing, Federal Licensing issued by ministries or governmental departments for regulated industries, and State Licensing issued by local authorities for regulated activities such as physical advertising and setting up a business premise, which varies according to the regulations of each State. Some examples of regulated industries are the financial sector, oil and gas sector, manufacturing sector, healthcare sector, and education sector.

You can find out more information on the business licences you need through the MalaysiaBiz portal.

Registration with the Inland Revenue Board Of Malaysia (LHDN)

When to get it done: As soon as possible

Similar to a personal income tax, your company is a separate legal entity that has to pay corporate taxes based on its annual chargeable income. LHDN will normally inform your company secretary regarding your corporate tax number.

However, in some rare cases where your company is not automatically registered, you can get your corporate tax number by registering through the e-Daftar portal.

Registration with Employees Provident Fund (EPF) and Social Security Organization (SOCSO)

When to get it done: Within 7 days (for EPF) and 30 days (for SOCSO) upon hiring the first employee

EPF is a retirement saving scheme for employees who are liable to contribute EPF in Malaysia. The saving is comprised of the employee’s and employer’s monthly contributions and yearly dividends earned. On the other hand, SOCSO manages 2 schemes - Employment Injury Scheme that protects an employee against occupational accident or disease, and the Invalidity Scheme that insures an employee who is unable to work due to incurable or unlikely to be cured condition or death.

Before you can register your employees under EPF and SOCSO, you have to register your company as an employer first at any EPF counter. As for SOCSO, you can register online. You can do this yourself or engage a payroll service provider to do it on your behalf by providing them with an authorised letter.

Financial Year End (FYE) lodgement

When to get it done: As soon as possible

The Financial Year End of a company is the date when the company closes its financial accounts. It is usually the last day of a particular month you have decided for your business.

You should inform your company secretary of the FYE decided for your company as early as possible.

Auditor appointment

When to get it done: Within 30 days after your first FYE

Unlike accountants and lawyers, an auditor has to be appointed by providing consent to act before they can provide auditing services to the company. They are in charge of preparing audited financial statements of your company. This can be done once and the same auditor will be automatically appointed every year. If your company is dormant, has zero revenue, and is threshold-qualified, you don't have to appoint an auditor for your company.

Your company secretary will submit the information of the auditor appointed in Annual Returns.

Annual compliance for Sdn Bhd

These are the compliance activities to be done annually for your company.

Business licence renewal

When to get it done: Depends; typically ranges from every year to every few years

Depending on the governmental authorities that regulate the specific licence, business licences usually require renewal annually or every few years. It is recommended to keep this in mind when you first apply for the licence to make sure your business licence is always up-to-date.

Submission of tax estimates

When to get it done: Within 3 months of operation and 30 days before the start of each assessment year

The estimated tax payable will be calculated based on the estimated annual income of your business. Your company will make monthly instalments based on this estimated tax payable.

You can submit this tax estimates on your own or engage an accountant or tax agent. The tax estimates can be revised if needed. It is recommended to seek advice from an accountant or tax agent on this matter.

Submission of statements regarding PCB

When to get it done: By 31st March of the following year

Your company as an employer should submit Form E, the statement of remuneration paid to employees and PCB deducted during the year, to LHDN. Besides, Form EA/(C.P. 8A), the statement of remuneration paid to employees during the year must be issued to the employees by the last day of February of the following year to allow employees to prepare their tax return.

You can sort this out on your own or engage an accountant or payroll service provider.

Financial Statements with Directors' Report lodgement

When to get it done: To be circulated to shareholders within 6 months after the FYE and lodged within 30 days after the circulation

Financial statements of the year are usually prepared by the accountants before being audited by your appointed auditor. On the other hand, the auditor will prepare an auditor’s report while the directors will prepare the director’s report which explains information on the directors, main activities of the company, shares, dividends, business reviews, etc. These documents are then compiled and signed by the commissioner for oaths before being passed to the company secretary for circulation to shareholders and the auditor.

Once it is approved by the board, your company secretary will lodge the financial statements with the directors' report attached to the SSM.

Annual return lodgement

When to get it done: Within 30 days from the anniversary of the company incorporation date

The annual return is a summary of your company with information such as business nature, registered address, directors and shareholders, etc. This information still has to be lodged to confirm that there were no changes to your business, even if there were no changes made to this information after a year of operating the company.

Your company secretary will prepare the annual return on the anniversary of the company incorporation date and lodge the documents to the SSM.

Submission of tax return

When to get it done: Within 7 months after the assessment year ends

The estimated tax payable and the actual tax payable might be different. After the assessment year ends, if the actual tax liability is greater than the taxes paid based on estimation, the balance of tax payable has to be paid. Vice versa, you can apply for a refund if the actual tax liability is lower than the taxes paid. This can be done through the submission of tax return through the e-filling portal.

You can sort this out on your own or engage an accountant or tax agent.

Monthly compliance for Sdn Bhd

These are the compliance activities to be done monthly for your company.

Corporate tax payment

When to get it done: Starting from the 6th month of the assessment year by the 15th of each month

Based on the estimated tax payable, you will pay corporate tax through monthly instalments. You can do this on your own or engage with an accountant or tax agent.

EPF, SOCSO, and EIS payment

When to get it done: By the 15th of the month for the salary issued for the previous month

Besides registering and regularly updating the information of your employees with EPF and SOCSO, your company as an employer needs to collect the EPF, SOCSO, and EIS contributions from both employer's and employees' shares and pay it to EPF and SOCSO respectively.

You can do this on your own through various online and offline channels of EPF and SOCSO or engage a payroll service provider for their services.

Employees' payroll tax (PCB) payment

When to get it done: By the 15th of each month for the remuneration issued for the previous month

More commonly known as PCB (potongan cukai bulanan), your company as an employer needs to retain a percentage of the employees’ remuneration including salary, commission, bonus, incentives, etc. to be paid as Monthly Tax Deduction (MTD) to LHDN on behalf of employees who are taxable as part of the employer’s responsibility. The calculation of PCB can be done based on the MTD schedule or through the Computerised Calculation Method on the e-CP39 portal.

You can do this on your own or engage with an accountant or tax agent.

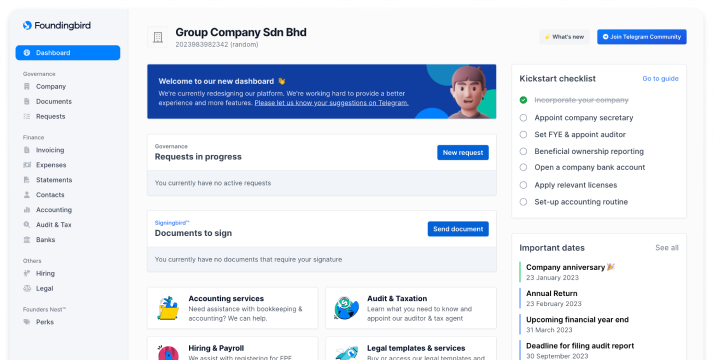

The complete checklist of annual and monthly compliance for Sdn Bhd

Here's a checklist of the annual and monthly compliance summarised from the article for your reference. It is recommended to talk to your company secretary for more information on statutory compliance required for your business.

👉 Download the PDF version of the checklist here!

Besides the compliance activities listed above which should generally be followed by all Sdn Bhd in Malaysia, there are other compliances such as:

- If you hire foreign employees, visa renewal is required annually or every few years according to visa requirements.

- If your annual sale or service revenue is more than RM500,000 in 12 months, you have to register your company for SST, submit the tax return and pay the tax every 2 months.

- If you are running a F&B business, all employees who handle food need to get vaccination(s) which should be boosted every few years.

The list goes on and varies according to the industry of your business. If you are unsure of the compliance requirements for your business, you should seek advice from your company secretary, accountant, tax agent, and other professionals, or contact relevant governmental authorities for more information.

Table of Contents

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →