8 key updates of the Companies Act 2016 for SMEs in Malaysia

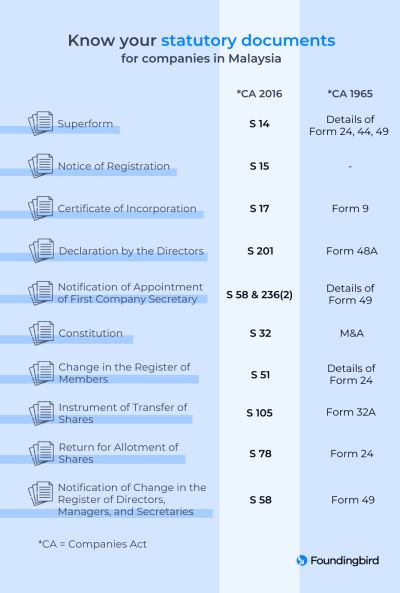

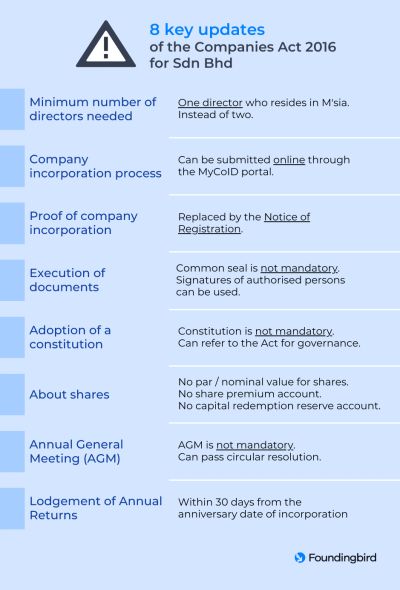

Taking effect on 31st January 2017, the Companies Act 2016 was established by the Companies Commission of Malaysia (SSM) to replace the Companies Act 1965, with several key updates to benefit SMEs greatly such as lowering the minimum requirements for the company incorporation of a Sdn Bhd and simplifying the mandatory compliances that a Sdn Bhd has to follow. These are the 8 key updates you need to know as an entrepreneur planning to incorporate and run a Sdn Bhd in Malaysia.

Digitalized application process for company incorporation

Instead of manually filling in the required forms downloaded from the SSM website, entrepreneurs can now incorporate their Sdn Bhd online by filling in the Super Form on the MyCoID 2016 portal. Here's the Malaysian's guide to Sdn Bhd company incorporation using the MyCoID portal for your reference.Reduced number of directors required

Prior to the Companies Act 2016, a Sdn Bhd required at least 2 directors to register. Today, only 1 director, regardless of his or her nationality, who is residing in Malaysia that fulfils the requirement is needed to incorporate a Sdn Bhd. The director can also act as the sole shareholder that owns 100% shares of the Sdn Bhd.Changed document for evidence of incorporation

Instead of a Certificate of Incorporation, a Notice of Registration will be issued as soon as the Sdn Bhd incorporation is approved by the SSM. You can still purchase the Certificate of Incorporation for the purpose of opening a business bank account, applying for business loans and other processes that require the certificate.

Simplified process for the execution of documents

As it is no longer mandatory for Sdn Bhd to have a common seal in the Companies Act 2016, the execution of documents can be done by either one of the options below:- Affixing of the common seal as outlined in the Act.

- Signatures of 2 authorised persons, 1 of them should be the director.

- Signatures of the sole director and 1 witness.

No par or nominal value for shares

All shares will no longer be tied with a par or nominal value; hence, the Sdn Bhd can decide the appropriate value for the shares for issuance. The Companies Act 2016 has also abolished the share premium account and capital redemption reserve account which have been merged with the company's share capital.Not mandatory to adopt a constitution

The Companies Act 2016 can be used as a constitution for Sdn Bhd incorporated under this new Act, which means it is not mandatory for the Sdn Bhd to have a memorandum and articles of association (M&A). The company, directors, and shareholders have the rights, powers, duties and obligations as stated in this Act. However, it is recommended to adopt a constitution under certain situations.Not mandatory to hold an Annual General Meeting

Sdn Bhd no longer has to hold an Annual General Meeting (AGM) each year. All decisions of the company can be made through circular resolutions which are signed by all directors with or without without holding a physical meeting. This is where electronic signatures can come in handy for businesses.Changed requirements on lodging annual returns

Instead of lodging the annual return 1 month from the date of AGM, it should be lodged 30 days from the anniversary date of incorporation, without having to lodge the financial statement at the same time. The financial statement should be lodged no later than 6 months from the financial year-end of the company and within 30 days from the time it is circulated among the shareholders.

With the implementation of the Companies Act 2016 and the Budget 2020 that favours the growth of entrepreneurship and SMEs, this is a good time to start a business in Malaysia with the support of the Malaysian government towards SMEs. Understanding the information needed to incorporate a Sdn Bhd in advance and incorporate your company online makes starting a Sdn Bhd in 1 working day possible!

Table of Contents

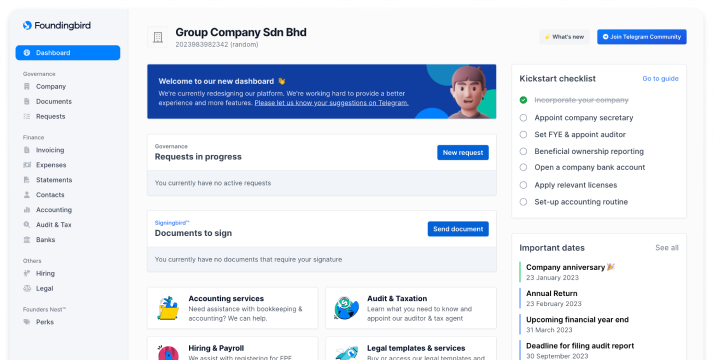

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →