The roles of directors and shareholders in a Sdn Bhd company

Being new to the journey of entrepreneurship means there are many business jargons to get used to, especially if you are incorporating a company for the first time. Besides deciding the amount of paid-up capital and the number of shares for your company, you need to appoint directors and shareholders as well. Who are the directors and shareholders of the company, and how do they contribute to the business in general?

Directors

Directors, also known as the board of the company, are individuals who are directly involved in decision making and the operation of the company. All Sdn Bhd companies in Malaysia are required to have at least 1 director who resides in the country. To become a director of a company, the person must be at least 18 years old and is not disqualified under Section 198 of the Companies Act 2016. A director is not necessarily a shareholder of the company. In the company incorporation process, directors are sometimes known as the promoters.Responsibilities of directors

Directors are expected to utilise their knowledge and experience when running the company and make well-informed decisions with the best interests of the company in mind. Due to their position as the management of the company, they should avoid any conflict of interest such as by engaging in businesses that compete with the company and should not take advantage of the company for their personal benefits.These are part of the duties of directors:

- Execute official documents such as partnership agreements, business contracts, etc. with their signatures, in replacement of a common seal.

- Prepare director reports that explain the business operation and profits earned for the financial year, which will be submitted together with the financial statements.

- Issue shares upon approval of shareholders.

Rights of directors

With great responsibilities directors are holding, they are allowed to seek help from professionals such as lawyers, accountants, business advisors, etc. in gathering information to make decisions or prepare reports for the company.Similar to employees of a company, directors are paid a director fee, as approved by the board and shareholders. However, the company cannot provide a loan or become a guarantor of the loan to its director or anyone connected to the director, unless it is approved by the shareholders.

Shareholders

Shareholders, also known as members, are the owners of the company. They can be individuals or corporate bodies, such as a Sdn Bhd, who own part of the company through the subscription of shares (buy shares). A private limited company can have up to 50 shareholders. Since they financially back up the company, they have indirect control over the operation of the company. If there is only 1 shareholder in the company, it means that person is the sole owner of the company, holding 100% of the shares. In the company registration process, shareholders are sometimes known as subscribers.Responsibilities of shareholders

Even though shareholders do not directly manage the company, as owners of the company they hold liabilities too, especially on any amount of the unpaid shares held.These are part of the duties of shareholders:

- Authorise the directors to increase the paid-up capital or to issue shares.

- Establish and amend a constitution, if there is any.

- Approve the disposal or acquiring of properties under the company name.

- Approve the financial statements prepared by the directors.

- Approve transactions of more than RM250,000, or between RM50,000 and RM250,000 if it is more than 10% of net assets owned by the company.

Rights of shareholders

Shareholders can request directors to hold shareholder meetings in order to discuss matters related to the business. They can raise concerns and questions regarding the decisions made by directors on behalf of the company.Unlike directors, shareholders receive a percentage of dividends according to the annual profits of the company. If the company is issuing new shares, existing shareholders have the priority in buying these shares first before they are taken up by third parties.

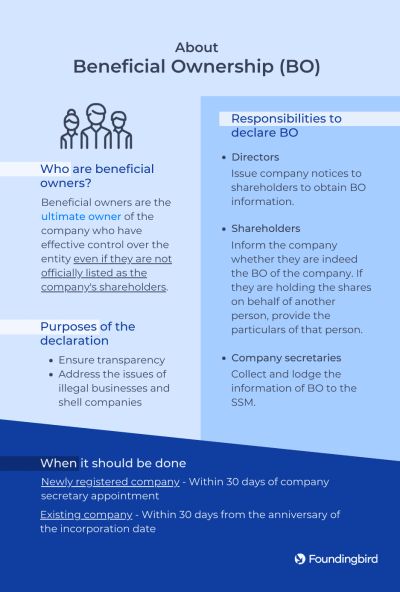

Update: About beneficial ownership

Beneficial owners are the ultimate owners of the company who have effective control over the entity, even if they are not officially listed as the company's shareholders. There are cases where beneficial owners have agreements with existing shareholders of a company to benefit from shareholding while preventing scrutiny from the authorities. The anonymity that comes with being a beneficial owner, without being a shareholder, can mask conflict of interests and potential fraud conducted by the beneficial owners.Mandatory to declare beneficial ownership

The SSM issued a guideline in March 2020 to make it mandatory for all companies to declare their ultimate beneficial owners for the sake of transparency in the company management, besides addressing the issues of illegal businesses and shell companies. The responsibilities of such declaration fall on:- Directors ?Ensure that the company obtains the beneficial ownership information by issuing company notices.

- Shareholders ?Upon receiving the company notice, inform the company whether they are indeed the beneficial owners of the company as described in the Companies Act 2016 and in the guideline. If the shareholders are holding the shares on behalf of another person, they must provide the particulars of that person.

- Company secretaries ?Ensure that the beneficial ownership information is collected and lodged to the SSM.

Director and shareholder positions can be held by the same or different persons. They play varying roles in the company to ensure a smooth and profitable business operation. If you are not starting your own business, you may have received an invitation to become a director or shareholder for a company. Hence, it is important to understand the roles and rights of these positions to make sure you are ready to take up responsibility and liability towards the company.

Table of Contents

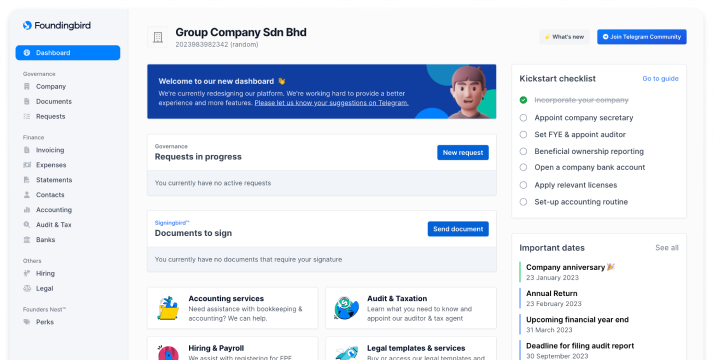

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →