EPF, SOCSO, and EIS Employer Contributions in Malaysia (2026 Update)

You may have noticed deductions from your monthly gross salary as stated on your payslip during your time as an employee before starting a company. Now that you are an employer, there are some monthly contributions that you have to make towards Employee Provident Fund (or KWSP in Malay) and Social Security Organisation (or PERKESO in Malay) for your employees' benefits as required by the laws in Malaysia, namely EPF, SOCSO, and EIS.

Recent Regulatory Updates

- October 2025: Mandatory EPF contributions for foreign workers (2% employer + 2% employee)

- October 2024: SOCSO and EIS wage ceiling increased from RM4,000 to RM6,000

1. Employees Provident Fund (EPF) contribution

Governed under the Employee Provident Fund Act 1991, EPF is a retirement saving scheme for employees who are liable to contribute EPF in Malaysia in which the savings contributed will be managed and invested under Simpanan Konvensional or Simpanan Shariah. The saving is comprised of the employee’s and employer's monthly contributions and yearly dividends earned.

Monetary payments that are subject to EPF contribution are:

- Salaries

- Payment for unutilised annual or medical leave

- Bonuses

- Allowances (with some exceptions)

- Commissions

- Incentives

- Arrears of wages

- Wages for maternity leave, study leave, half-day leave

- Other contractual payments or otherwise

- Service charges such as tips

- Overtime payments, including payments for work carried out on rest days and public holidays

- Gratuity (payment to employee payable at the end of a service period or upon voluntary resignation)

- Payment in lieu of notice of termination of service (payment given when employee’s service is terminated)

- Retirement benefits

- Termination benefits

- Travel allowances

- Director’s fee

- Gifts, including cash payments for holidays like Hari Raya, Christmas, etc.

- Benefits-in-kind and nonmonetary perquisites

Employer's responsibility on EPF contribution

- Register with the EPF as an employer within 7 days upon hiring the first employee.

- Register your employees as EPF members and keep their information updated.

- Provide salary statements to employees.

- Collect your employees’ share of EPF contribution and submit it to the EPF along with the employer's share.

Tax Relief Note: Employee EPF contributions (both mandatory and voluntary) are tax-deductible up to a maximum of RM4,000 per year based on actual contributions made. This means employees can claim the amount they actually contributed, capped at RM4,000 annually.

Mandatory EPF for Foreign Workers (Effective October 2025)

A significant change came into effect in October 2025: foreign workers are now required to contribute to EPF. This marks a major shift from the previous RM5.00 flat-rate employer contribution.

Key Points for Foreign Worker EPF:

- Contribution rate: 2% employer + 2% employee

- Applies to wages paid from October 2025 onwards (November 2025 contribution month)

- Covers all foreign employees with valid employment passes (except domestic workers)

- Foreign workers can withdraw EPF savings when leaving Malaysia permanently

- First contribution payment due by 15 November 2025

This new requirement applies to all non-Malaysian citizen employees holding employment passes, professional visitor passes, residence passes, and certain other valid work permits. Foreign workers will need to be registered as EPF members, which for most employment pass holders will be done automatically without requiring a visit to an EPF office.

Employer's and employee's contribution rate for EPF (as of 2026)

| Employee's status | Employer's EPF contribution rate | Employee's EPF contribution rate | ||

| Monthly salary rate | RM5,000 and below | More than RM5,000 | RM5,000 and below | More than RM5,000 |

| Malaysian age 60 and above | 4% | 0% | ||

| Malaysian below age 60 | 13% | 12% | 11% | |

| Permanent resident below age 60 | 13% | 12% | 11% | |

| Permanent resident age 60 and above | 6.5% | 6% | 5.5% | |

| Foreign workers (effective October 2025) | 2% | 2% | ||

Important note: The temporary reduction of employee EPF contribution from 11% to 9% (announced in Budget 2021) expired in January 2022. All Malaysian citizens and permanent residents under 60 years old now contribute at the statutory rate of 11%.

💰 Try Our Salary Calculator

Want to see how EPF, SOCSO, and EIS contributions affect your take-home pay? Use our free calculator to get an instant breakdown.

Calculate Your Net Pay →Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Third Schedule of the EPF Act 1991, instead of using the exact percentage calculation, except for salaries that are more than RM20,000.00.

When should EPF contribution be paid?

The monthly payment of EPF contribution comprising of both employees' and employer’s share should be paid by the 15th of the month for the salary issued for the previous month. A late payment charge or a dividend will be imposed if the EPF contribution is not paid on time.How to make EPF payment?

The EPF contribution can be paid through the following channels:- e-Caruman website or mobile application

- Internet banking

- Bank agents of Bank Simpanan Nasional, Maybank, Public Bank, and RHB Bank

- EPF counters nationwide

Penalties for late or non-payment of EPF

Employers who fail to make timely EPF contributions face significant penalties under the EPF Act 1991. It is crucial to ensure contributions are paid by the 15th of each month to avoid these consequences.

Late Payment Charges

- Late Payment Charge: Calculated based on the EPF dividend rate plus 1% per annum, with a minimum charge of RM10 (rounded up to the nearest ringgit)

- Dividend Charge: Employers must pay dividends accrued on late contributions based on the current EPF dividend rate for the year

- Payment deadline: Contributions must be paid by the 15th of each month for the previous month's salary. If the 15th falls on a public holiday or weekend, payment on the next working day will not incur penalties

- Criminal penalties: Conviction for non-payment can result in fines up to RM10,000 or imprisonment up to 3 years, or both

Employers can use the EPF Late Payment Charge Calculator to estimate potential penalties for late contributions.

2. Social Security Organization (SOCSO) contribution

There are 2 schemes that are governed under the Employees' Social Security Act 1969 – the Employment Injury Scheme that protects an employee against occupational accident or disease, and the Invalidity Scheme that insures an employee who is unable to work due to incurable or unlikely to be cured condition or death. It is compulsory for all Malaysian and permanent resident employees to register with SOCSO except for Federal and State Government permanent employees, domestic servants, and those who are self-employed. Foreign workers are protected under SOCSO as well since January 2019.

Monetary payments that are subject to SOCSO contribution are:

- Salaries

- Overtime payments

- Commissions

- Wages for maternity leave, study leave, half-day leave

- Other contractual payments or otherwise

- Any contribution payable by the employer towards any pension or provident fund

- Gratuity (payment to employee payable at the end of a service period or upon voluntary resignation)

- Any sum paid to cover expenses incurred by the employee in the course of his duties

- Bonuses

- Travel allowances

- Gifts, including cash payments for holidays like Hari Raya, Christmas, etc.

Employer's responsibility on SOCSO contribution

- Register yourself as an employer within 30 days upon hiring the first employee.

- Register your employees as SOCSO members and keep their information updated.

- Report all work-related accidents that befall their workers within 48 hours.

- Maintain a monthly record of employees' information and keep the information updated.

- Collect your employees’ share of SOCSO contribution and submit it to the SOCSO along with the employer's share.

Employer's and employee's contribution rate for SOCSO

| Employee's status | Employer's SOCSO contribution rate | Employee's SOCSO contribution rate |

| Age below 60 (Malaysian & PR) | 1.75% (Employment Injury + Invalidity Scheme) | 0.5% |

| Age 60 and above (Malaysian & PR) | 1.25% (Employment Injury Scheme only) | 0% |

| Foreign workers (all ages) | 1.25% (Employment Injury Scheme only) | 0% |

Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Rate of Contribution table on the SOCSO website, instead of using the exact percentage calculation. As of October 2024, the monthly contribution is capped at a monthly salary of RM6,000 (increased from RM4,000).

Need a quick calculation? Our salary calculator computes SOCSO, EPF, EIS, and income tax in seconds.

When should SOCSO contribution be paid?

The monthly payment of SOCSO contribution comprising of both employees' and employer's share should be paid by the 15th of the month for the salary issued for the previous month.

Late Payment Penalties

A late payment interest rate of 6% per annum per day will be charged for each day of contribution not paid. This compounds quickly and can result in substantial penalties for delayed payments.

It is crucial to ensure SOCSO and EIS contributions are submitted on time to avoid these penalties and maintain compliance with Malaysian employment law.

How to make SOCSO payment?

The SOCSO contribution can be paid through the following channels:- PERKESO ASSIST portal

- Internet banking

- Cheque, money order, or postal order

- Bank counters

- Bank agents of Maybank, RHB Bank, and Public Bank

- SOCSO counters nationwide

3. Employment Insurance System (EIS) contribution

Governed under the Employment Insurance System Act 2017 and administered by SOCSO as well, this insurance protects employees aged 18 to 60 who have lost their employment except in the case of voluntary resignation, expiry of the contract, unconditional termination of the contract, completion of a project specified in a contract, retirement, and dismissal due to misconduct.

Employer's responsibility

You only need to register your employees once as SOCSO members and they are automatically entitled to EIS.Employer's and employee's contribution rate for EIS

| Employee's status | Employer's and employee's EIS contribution rate |

| Age 18 to 60 | 0.2% |

Please bear in mind that the contribution amount should be calculated based on the contribution rate as stated in the Second Schedule of the Employment Insurance System Act 2017, instead of using the exact percentage calculation. As of October 2024, the monthly contribution is capped at a monthly salary of RM6,000 (increased from RM4,000).

Confused by the calculations? Use our interactive calculator to see real-time breakdowns with income tax estimates.

When should EIS contribution be paid?

The EIS contribution for employees' and employer’s share is paid together with SOCSO contribution.How to make EIS payment?

The EIS contribution can be paid through the same channels as the SOCSO contribution.Malaysia Payroll Calculator (2026)

Calculate EPF, SOCSO, EIS contributions and estimated income tax (PCB/MTD) instantly with our interactive calculator based on 2026 Malaysian regulations.

EPF contributions are tax-deductible up to RM4,000/year (based on actual contributions). Add more for other tax reliefs (spouse, children, life insurance, etc.).

Frequently Asked Questions (FAQ)

Here are answers to common questions employers have about EPF, SOCSO, and EIS contributions in Malaysia.

What happens if I pay EPF, SOCSO, or EIS contributions late?

EPF: Late payment charges are imposed based on the EPF dividend rate plus 1% per annum, with a minimum charge of RM10. Criminal penalties can include fines up to RM10,000 or imprisonment up to 3 years.

SOCSO: A late payment interest rate of 6% per annum per day is charged for each day the contribution remains unpaid.

EIS: Late payment penalties follow the same structure as SOCSO contributions.

Can foreign workers withdraw their EPF contributions?

Yes. Foreign workers can withdraw their EPF savings when leaving Malaysia permanently. The withdrawal process requires proof of departure and cancellation of work permit. Foreign workers should check with EPF for the latest withdrawal procedures and required documentation.

What's the difference between SOCSO's Employment Injury Scheme and Invalidity Scheme?

Employment Injury Scheme: Protects employees against occupational accidents or diseases that occur during work. This covers all employees including those aged 60+ and foreign workers.

Invalidity Scheme: Insures employees who are unable to work due to incurable conditions or death unrelated to work. This only applies to Malaysian citizens and permanent residents under age 60.

Do I need to calculate contributions using exact percentages?

No. For EPF, you must use the Third Schedule contribution tables for salaries up to RM20,000. Only salaries above RM20,000 use exact percentage calculations. For SOCSO and EIS, always use the official Rate of Contribution tables rather than exact percentages, as contributions are capped at the RM6,000 wage ceiling (as of October 2024).

How did the wage ceiling increase from RM4,000 to RM6,000 affect my contributions?

Effective October 2024, employees earning between RM4,001 and RM6,000 now have higher SOCSO and EIS contributions calculated on their full salary (up to RM6,000) rather than being capped at RM4,000. This affects both employer and employee contribution amounts. Employees earning above RM6,000 still have contributions capped at the RM6,000 ceiling.

Are part-time or contract employees covered under EPF, SOCSO, and EIS?

EPF: Yes, if they are employees liable to contribute (generally those earning above RM5,000 or voluntarily contributing if earning less).

SOCSO: Yes, all employees under a contract of service are covered, regardless of part-time or full-time status.

EIS: Yes, employees aged 18 to 60 earning monthly wages are covered under EIS.

Can employees opt out of EPF, SOCSO, or EIS contributions?

Generally, no. These are mandatory statutory contributions for eligible employees. However, there are specific exemptions based on age, employment type, and nationality as outlined in the respective Acts. Employees cannot simply opt out if they meet the eligibility criteria.

What should I do if I've been making incorrect contributions?

Contact EPF and SOCSO immediately to rectify the situation. You may need to make backdated payments for underpayments or request refunds for overpayments. Keep detailed records of all salary payments and contributions. Consider engaging a payroll service provider or HR consultant to prevent future errors.

What is HRDF (HRD Corp) and do I need to register?

The Human Resource Development Fund (HRDF), now known as HRD Corp (Pembangunan Sumber Manusia Berhad), is a training levy scheme that's often overlooked by new employers but is mandatory for certain industries.

Who must register:

- Companies with 10 or more employees

- Operating in covered industries (manufacturing, services, mining, quarrying, and more)

- Must register within 3 months of reaching the threshold

Contribution rate: 1% of monthly payroll for companies with 10-49 employees, 0.5% for 50+ employees (varies by industry)

Benefits: Access to training grants and subsidies to upskill your workforce

Important Note:

HRDF is subject to audits and non-compliance can result in fines. Many foreign companies expanding into Malaysia are caught off guard by this requirement. Check HRD Corp's website to verify if your industry is covered.

While HRDF is separate from EPF, SOCSO, and EIS, it's another important statutory requirement that employers should be aware of when budgeting for total employment costs.

Compliance Summary: Key Deadlines and Penalties

Staying compliant with EPF, SOCSO, and EIS regulations requires understanding key deadlines and potential penalties. Here's a quick reference guide:

Payment Deadlines

| Contribution Type | Payment Deadline |

|---|---|

| EPF Contribution | By the 15th of each month for previous month's salary |

| SOCSO Contribution | By the 15th of each month for previous month's salary |

| EIS Contribution | Paid together with SOCSO (by the 15th) |

Penalty Summary

- EPF Late Payment: Late Payment Charge (EPF dividend rate + 1%, minimum RM10) plus potential criminal penalties (up to RM10,000 fine or 3 years imprisonment)

- SOCSO Late Payment: 6% per annum per day interest on outstanding contributions

- Non-registration: Penalties apply for failing to register as an employer within required timeframes (7 days for EPF, 30 days for SOCSO)

Need Help Managing Your Payroll & Statutory Contributions?

Managing EPF, SOCSO, EIS contributions has become more complex with recent regulatory changes. Let us handle it for you.

With new mandatory EPF requirements for foreign workers and increased wage ceilings, ensuring accurate and timely payroll compliance is more critical than ever. Our HR & Payroll Outsourcing service takes care of everything from statutory registrations to monthly submissions—so you can focus on growing your business.

What We Handle For You:

- Initial Statutory Registration: EPF (KWSP), SOCSO (Perkeso), EIS, PCB/MTD & LHDN setup

- Monthly Payroll Processing: Full payroll calculation, bank files, and payslip generation

- Statutory Submissions: Timely submission of all EPF, SOCSO, EIS & PCB reports

- Talenox HR Platform: Leave management, claims, time attendance tracking

- Compliance Assurance: Stay up-to-date with all Malaysian employment regulations

Starting from RM200/month

Learn More About Our HR & Payroll Services →Or WhatsApp us for a free consultation

Last updated: January 2026. Contribution rates and regulations are subject to change. Always verify current requirements with EPF and SOCSO official sources.

Table of Contents

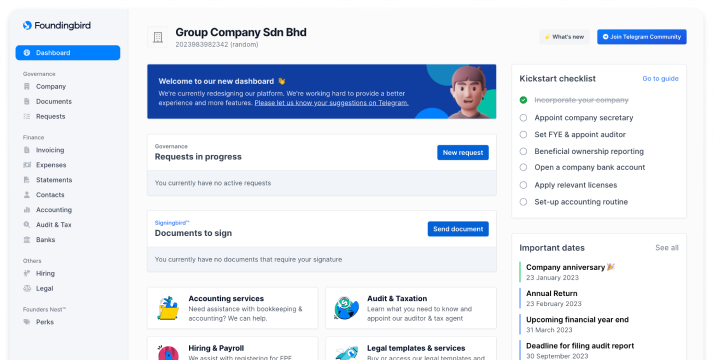

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll