6 important company taxes in Malaysia (with tax rates of 2021)

Running your business as a separate legal entity through a private limited company provides you with benefits such as personal financial security and access to funding, but it also requires compliance with laws and regulations in Malaysia. One of the most concerning compliances that many entrepreneurs face is taxes as required by the Inland Revenue Board (LHDN) and the Royal Malaysian Customs Department (RMCD). Understanding each company tax requirement can put you at ease on this matter so that you put more focus on growing your business.

1. Corporate tax

Corporate tax is governed under the Income Tax Act 1967, which applies to all companies registered in Malaysia for chargeable income derived from Malaysia including business profits, dividends, interests, rents, royalties, premiums and other income.

Tax rates of corporate tax (as of Year of Assessment 2021)

| Paid-up capital of RM2.5 million or less | Rate |

| On the first RM 600,000 chargeable income | 17% |

| On subsequent chargeable income | 24% |

| Paid-up capital of more than RM2.5 million | Rate |

| Flat rate | 24% |

When to pay corporate tax?

Newly registered companies should file the estimation of tax payable within 3 months of operation and make monthly instalments starting from the 6th month of the assessment year by the 15th of each month. After the assessment year has ended, a company is required to file its tax to the LHDN through the e-filling portal within 7 months. If the actual tax liability is greater than the taxes paid based on estimation, the balance of tax payable has to be paid. On the other hand, you can apply for a refund if the actual tax liability is lower than the taxes paid.

2. Withholding tax

Withholding tax is applicable only if your company is paying a non-resident individual or company (known as the payee) for their services where a certain percentage of the payment is deducted and paid as their income taxes to the LHDN. Each payment type has a different tax rate according to Section 107A and Section 109 of the Income Tax Act 1967. Under the Double Taxation Agreements (DTA), you may apply for a refund of overpaid withholding tax.

Tax rates of withholding tax

| Payment Type | Rate |

| Contract payment for services done in Malaysia | 10% , 3% |

| Interest | 15% |

| Interest paid by approved financial institutions | 5% |

| Royalty | 10% |

| Special classes of income: Technical fees, payment for services, or payment for use of moveable property | 10% |

| Income of non-resident public entertainers | 15% |

| Real Estate Investment Trust | 10%, 25% |

| Family Fund / Takaful Family Fund / Dana Am | 8% , 25% |

| Others | 10% |

| Payment Type | Rate |

| Contract payment for services done in Malaysia | 10% , 3% |

| Interest | 15% |

| Interest paid by approved financial institutions | 5% |

| Royalty | 10% |

| Special classes of income: Technical fees, payment for services, or payment for use of moveable property | 10% |

| Income of non-resident public entertainers | 15% |

| Real Estate Investment Trust | 10% , 25% |

| Family Fund / Takaful Family Fund / Dana Am | 8% , 25% |

| Others | 10% |

When should the tax be paid?

The withholding tax should be paid within 1 month from the date of payment to the non-resident payee.

3. Payroll tax

As part of the employer's responsibility, a company with employees will need to retain a percentage of the employees' remuneration including salary, commission, bonus, incentives, etc. and pay as Monthly Tax Deduction (MTD) to LHDN on behalf of employees who are taxable. This deduction, along with EPF, SOCSO, and EIS, will be stated in the employees' payslip as PCB (potongan cukai bulanan). The payroll tax can be deducted if the employee is paying Zakat, a payment made under the Islamic law for charitable and religious purposes.

Tax rate of payroll tax

The calculation of PCB can be done based on the MTD schedule or through the Computerised Calculation Method on the e-CP39 portal. The amount of PCB required from each employee varies according to the category they fall in and also the amount of remuneration they receive each month.

When to pay payroll tax?

PCB should be paid to LHDN by the 15th of each month, for the remuneration issued for the previous month.

4. Stamp duty

Your company is required to pay for Stamp Duty when instruments are involved, which are written legal, commercial, and financial documents. Examples of taxable instruments are partnership agreement and mortgage agreement. There are two types of Stamp Duty, one with a fixed rate regardless of the amount stated in the instrument, the other which varies according to the nature of the instrument and the value stipulated. Besides some situations where the Stamp Duty is exempted, you may apply for Stamp Duty relief under certain cases.

Tax rate of stamp duty

All information regarding taxable instruments and exemptions are stated in the Stamp Act 1949. Instruments that are chargeable for Stamp Duty are listed in the First Schedule together with the rates while the persons liable to pay the Stamp Duty are listed in the Third Schedule.

When to pay stamp duty?

The instrument should be stamped within 30 days of the execution of the instrument. The following are ways to pay stamp duty:

- Digital Franking System

- Stamp certificate

- Compound duty

- Revenue stamp (can be obtained from post offices)

- Direct payment to the stamp duty counter

5. Sales & Service Tax (SST)

Sales tax is a single-stage tax charged on taxable goods manufactured in or imported into Malaysia by a taxable person and is due when the goods are sold, disposed of, or first used with a total sale value of more than RM500,000 in 12 months. There are exemptions for certain goods manufactured or imported. Effective from 23rd March 2020, the following items will be exempted from import duty and sales tax until a later date to be announced.

- Face masks

- Medical equipment such as infrared thermometers and thermal scanners

- Laboratory equipment such as Inverted Microscope Automated Extractor Machine

- Personal Protective Equipment (PPE) such as face and eye protection, gloves and protective garments for surgical/medical use

- Disposal items such as paper bed sheets, respiratory tubing and plastic test tubes

Not to be confused with service charge, service tax is charged on taxable services in Malaysia such as accommodation, gaming, telecommunication services, etc. provided by a taxable person with a total value of more than RM500,000 in 12 months. For the F&B industry, however, the threshold is a total value of more than RM1,500,000 in 12 months. Credit card services have no threshold and a different rate.

There are several laws that govern SST. You are required to register your company for SST if the requirements are met.

Tax rates of SST

| Type | Rate |

| Sales Tax | 5% or 10% or on specific rate |

| Service Tax | 6% |

* SST does not apply to Special Area.

When should the tax be paid?

SST should be paid bi-monthly, except for the 1st tax period after your registration with RMCD.

6. Real property gains tax (RPGT)

Real property gains tax is applicable only if your company disposes of chargeable assets such as houses, commercial buildings, farms, and vacant lands, and also shares in real property companies, gaining profit from the disposal. The calculation of chargeable gain is the disposal price minus by acquisition price. Governed under the Real Property Gains Tax 1976, the tax rates differ according to the holding period of the chargeable assets.

Tax Rates of RPGT

| Disposal Period (after the year of acquisition) | Rate |

| Within 3 years | 30% |

| The 4th year | 20% |

| The 5th year | 15% |

| The 6th year and above | 10% |

When to pay RPGT?

You and the acquirer of the chargeable assets are required to file the tax within 60 days from the date of disposal. The acquirer will pay part of the purchase consideration which will be deducted from the RPGT payable. After filling the tax, an assessment notice will be issued for taxable cases; for non-taxable cases, a certificate of non-chargeability will be issued instead. You are then required to pay the RPGT payable within 30 days from the date the assessment notice is issued.

Besides the taxes stated above, there are customs duty, excise duty, property taxes (cukai tanah and cukai pintu) and other taxes which might be applicable to your company according to industry and nature of business. Besides, please bear in mind that Labuan has a different tax regulation than other States in Malaysia. Fulfilling this obligation as a company should not be an obstacle that hinders your business growth or operations. Hence, understanding the taxes at the early stage of your business ensures full compliance with the tax law and regulations.

Table of Contents

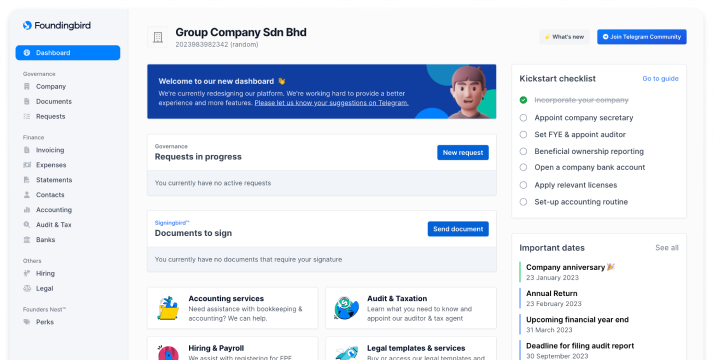

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll