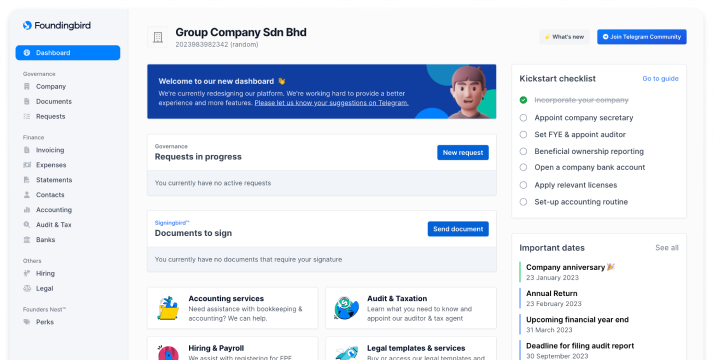

Enterprise vs Sdn Bhd in Malaysia: Which Should You Choose? (2026 Update)

A commonly asked question among entrepreneurs who want to start a new business for the first time is whether to register an enterprise or to incorporate a Sdn Bhd. In practice, many entrepreneurs start their business using an enterprise before deciding to set up a Sdn Bhd several years later. If you're unsure which option suits your business best, here's everything you need to know to make the right decision in 2026.

Quick comparison: Enterprise vs Sdn Bhd

Before we dive into the details, here's a quick overview of the key differences:

| Factor | Enterprise | Sdn Bhd |

|---|---|---|

| Setup Cost | RM30–60 | ~RM2000 |

| Setup Time | 1–2 days | 3–7 days |

| Annual Cost | ~RM60 renewal | ~RM3,500–7,000 (secretary, audit, tax) |

| Personal Liability | Unlimited | Limited to paid-up capital |

| Tax Rate (2026) | Up to 30% (personal) | 15–24% (corporate) |

| E-Invoicing | Required based on revenue | Required based on revenue |

| Can Raise Investment | No | Yes |

| Credibility | Lower | Higher |

| Best For | Freelancers, side hustles, testing ideas | Serious businesses, contracts with corporates, seeking investment |

What is an Enterprise?

An Enterprise refers to a Sole Proprietorship (one owner) or Partnership (2–20 owners). It is regulated under the Registration of Business Act 1956 and has no separate legal status from its owner. This means you and your business are considered as one entity, and you will be personally liable for all debts and obligations incurred by the business.

What is a Sdn Bhd?

A Sdn Bhd (Sendirian Berhad) is a private limited company regulated under the Companies Act 2016. Unlike an enterprise, a Sdn Bhd is considered a separate legal entity from its owners. This means the company can earn income, own property, sign contracts, sue and be sued in its own name. Your personal assets are protected from the company's liabilities, limited only to your paid-up capital.

Key differences between Enterprise and Sdn Bhd

Legal liability

This is the most important difference. With an enterprise, there is no separation between you and your business. If your business incurs debt or gets sued, your personal assets (house, car, savings) are at risk.

With a Sdn Bhd, your liability is limited to the amount of share capital you've invested. If the company fails, creditors cannot come after your personal assets (except in cases of fraud or wrongful trading).

Compliance requirements

An enterprise requires regular renewal with the Registrar of Business to keep the business running—typically RM30–60 annually.

A Sdn Bhd does not require renewal, but there are more compliance requirements from SSM, including:

- Appointment of a company secretary within 30 days of incorporation

- Lodgement of annual returns within 30 days from the anniversary of incorporation

- Submission of audited financial statements within 6 months of financial year-end

- Updating company information such as directors, shareholders, paid-up capital, and registered address

Both enterprise and Sdn Bhd must adhere to other regulatory requirements such as business licence applications, EPF and SOCSO registration for employees, and tax filing.

Ownership and management

For an enterprise, you can either own and manage a Sole Proprietorship on your own or share the ownership and responsibilities of a Partnership with up to 20 business partners.

A Sdn Bhd is owned by shareholders and managed by directors. Thanks to the Companies Act 2016, you can now be the sole shareholder and director of a Sdn Bhd without needing a business partner. The maximum number of shareholders a Sdn Bhd can have is 50.

Signing agreements and contracts

When you sign an agreement as an enterprise owner, you enter into the contract in your personal capacity. If there is a breach, you are held personally liable.

For a Sdn Bhd, you sign agreements on behalf of the company. The company bears the legal liability as it is a separate legal entity. Directors must typically pass a board resolution approving the agreement, though in practice, the board may delegate signing authority to certain roles like the CEO or manager.

Credibility and banking

Many corporate clients and government agencies only work with Sdn Bhd vendors. If you're planning to bid for contracts or work with larger companies, having a Sdn Bhd gives you more credibility.

Opening a business bank account is also more straightforward with a Sdn Bhd, as it clearly separates your business and personal finances. Sdn Bhd companies also have an easier time obtaining business loans and credit facilities.

Tax comparison for 2026

Since an enterprise has no separate legal status, all profits earned by the business are taxed as part of your personal income.

Personal income tax rates (Enterprise) for YA 2026:

| Chargeable Income (RM) | Tax Rate |

|---|---|

| 0 – 5,000 | 0% |

| 5,001 – 20,000 | 1% |

| 20,001 – 35,000 | 3% |

| 35,001 – 50,000 | 6% |

| 50,001 – 70,000 | 11% |

| 70,001 – 100,000 | 19% |

| 100,001 – 400,000 | 25% |

| 400,001 – 600,000 | 26% |

| 600,001 – 2,000,000 | 28% |

| Above 2,000,000 | 30% |

Corporate tax rates (Sdn Bhd) for YA 2026:

| Chargeable Income (RM) | Tax Rate |

|---|---|

| First 150,000 | 15% |

| 150,001 – 600,000 | 17% |

| Above 600,000 | 24% |

Note: The 15% and 17% rates apply to SMEs with paid-up capital of RM2.5 million or less and annual revenue not exceeding RM50 million.

For a Sdn Bhd, directors can receive remuneration (which is taxed as personal income), while shareholders receive dividends. Dividends are not taxed again at the personal level because the company has already paid corporate tax on its profits.

Tax savings comparison: Enterprise vs Sdn Bhd

The table below shows estimated annual tax at different profit levels, comparing an Enterprise (taxed as personal income) versus a Sdn Bhd (using an optimised salary and dividend strategy):

| Annual Profit | Enterprise Tax | Sdn Bhd Tax | Annual Savings |

|---|---|---|---|

| RM50,000 | ~RM900 | ~RM1,400 | Enterprise wins |

| RM100,000 | ~RM5,900 | ~RM5,200 | ~RM700 |

| RM150,000 | ~RM14,100 | ~RM10,500 | ~RM3,600 |

| RM200,000 | ~RM26,600 | ~RM16,500 | ~RM10,100 |

| RM300,000 | ~RM51,600 | ~RM30,000 | ~RM21,600 |

| RM500,000 | ~RM101,600 | ~RM57,000 | ~RM44,600 |

Break-even point: Around RM70,000–100,000 annual profit. Below this, an Enterprise is generally more cost-effective when you factor in compliance costs. Above RM150,000, the tax savings from a Sdn Bhd often exceed RM3,500/year—enough to cover the additional compliance costs.

E-Invoicing requirements

Malaysia's mandatory e-invoicing rollout is one of the biggest compliance changes affecting businesses. Both Enterprise and Sdn Bhd must comply based on their annual turnover:

| Annual Turnover | Mandatory From |

|---|---|

| Above RM100 million | 1 August 2024 |

| RM25–100 million | 1 January 2025 |

| RM5–25 million | 1 July 2025 |

| Up to RM5 million | 1 January 2026 (Extended to 2027*) |

| Below RM1 million | Exempted |

While both business structures must comply, Sdn Bhd owners who already have accounting and company secretarial support in place typically find the transition smoother. If you're running an enterprise and approaching the threshold, this may be a good time to consider converting to a Sdn Bhd and getting proper accounting systems in place.

Setup and annual costs comparison

| Cost Type | Enterprise | Sdn Bhd |

|---|---|---|

| Registration (SSM) | RM30–60 | RM1,010–1,600 |

| Company Secretary | Not required | RM1,200–2,400/year |

| Annual Renewal | RM30–60 | Not required |

| Audit | Not required | RM1,500–4,000/year* |

| Tax Filing | ~RM200–500 | ~RM800–2,000/year |

| Total Year 1 | ~RM100–200 | ~RM4,000–8,000 |

| Total Ongoing/Year | ~RM100–500 | ~RM3,500–7,000 |

While a Sdn Bhd costs more to set up and maintain, the benefits of limited liability, tax optimisation, and credibility often outweigh the costs for serious businesses.

When should you choose an Enterprise?

An enterprise is suitable if:

- You're testing a business idea part-time or as a side hustle

- Your annual revenue is under RM100,000

- You have no plans to raise investment from external investors

- You're working solo or with just 1–2 partners

- You're running a low-risk service business (e.g., freelance design, tuition, small trading)

- You want minimal paperwork and compliance

When should you choose a Sdn Bhd?

A Sdn Bhd is the better choice if:

- You want to protect your personal assets from business liabilities

- You're planning to raise funding from investors (angels, VCs, or crowdfunding)

- Your annual revenue exceeds RM100,000 (for tax optimisation)

- You need to sign contracts with corporates or government agencies (many require Sdn Bhd vendors)

- You're building a business you may want to sell in the future

- You're hiring employees and want to appear as a credible employer

- You're a foreigner—foreigners cannot register an enterprise and must incorporate a Sdn Bhd

Can I convert my Enterprise to a Sdn Bhd later?

Yes, but it's not a direct conversion. You will need to incorporate a new Sdn Bhd and transfer your business assets, contracts, and operations to the new company. You may then close the enterprise once the transition is complete.

Many entrepreneurs start with an enterprise to test their business idea, then transition to a Sdn Bhd once the business gains traction and they're ready to scale.

Frequently Asked Questions

Can foreigners register an Enterprise in Malaysia?

No. Foreigners must incorporate a Sdn Bhd to do business in Malaysia. Check out our foreigner's guide to company incorporation for more details.

Do I need an office address for a Sdn Bhd?

Yes, a registered address is required. Many company secretaries, including Foundingbird, provide virtual office services if you don't have a physical office.

Can a Sdn Bhd have just one person?

Yes. Since the Companies Act 2016 came into effect, you can be the sole director and sole shareholder of a Sdn Bhd.

Which is better for a freelancer?

For most freelancers earning under RM100,000 per year, an enterprise is simpler and cheaper. Consider a Sdn Bhd when you want liability protection, plan to scale, or need to work with corporate clients who require it.

Can I run multiple businesses under one Enterprise or Sdn Bhd?

Yes, both structures allow you to operate multiple business activities. However, a Sdn Bhd provides better legal separation if one business activity faces issues.

Make the right choice for your business

While running your business as a Sdn Bhd has clear benefits in terms of liability protection, tax optimisation, and credibility, it's perfectly fine to start with an enterprise if you're just testing the waters. Understanding the differences helps you make the decision that suits your business stage and goals.

If you're ready to incorporate your Sdn Bhd or have questions about which structure is right for you, chat with us on WhatsApp or start your incorporation online today.

Table of Contents

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

Form 9? S17? - Know the statutory forms of your Sdn Bhd

Complete guide to Sdn Bhd statutory forms: S14, S15, S17, S51, S58, S78, S105. Learn what replaced Form 9, Form 24, Form 49 under Companies Act 2016.

Read more →