5 important things to figure out before incorporating your company

Company incorporation is a significant step towards the launching of a business. Understanding the legal requirements and information needed for the incorporation of your Sdn Bhd in advance not only saves you the considerable hassle many associates with filling out the incorporation form; it also allows you to fully channel your focus into making those major decisions that truly matter to your company. Here’s a list of details that should be figured out prior to submitting the incorporation form to help you in the process of successfully incorporating your Sdn Bhd in Malaysia.

Company and business information

Proposed company names

According to the guidelines for naming a company issued by the Companies Commission of Malaysia (SSM), it's imperative that your proposed company name:- Does not suggest connections with the Royal families or governmental bodies and authorities with words like ‘royal’, ‘federal’, and ‘ASEAN’.

- Is not misleading regarding the nature of business.

- Is not blasphemous or likely to be offensive.

- Does not resembling or may be mistaken for another registered company.

- Does not suggest connections with activities controlled by other laws such as ‘insurance’, ‘estate agent’, and ‘takaful’ unless written approval from the relevant agency is obtained.

- Does not suggest connections with activities regulated by government agencies or professional bodies with words like ‘architect’, ‘co-op’ and ‘engineer’ unless written approval from the relevant agency is obtained.

Complete intelligibility is important in naming your company. If the proposed company name contains words outside of the Malay and English language, you need to explain the meaning of such words when filling in the company incorporation form.

Business nature and description

It is important to clarify the type of business your Sdn Bhd will be undertaking. All businesses in Malaysia are classified using the MSIC code. If you are unsure of which category your company falls into, it’s best to consult a company secretary on this matter by providing a detailed description of your business purposes.

Business address and registered address

Your business address and registered address do not have to be the same. While a business address is where your business operations and activities are conducted, a registered address is usually the company secretary office where all communications and notices may be addressed and should be accessible to the public during normal business hours.In the case that you do not have a physical office or shop, a business address is not required.

Your eligibility as the company director and shareholder

Directors and shareholders play different roles where directors are the management of the company and shareholders are the owners of the company.

Director

Both Malaysians and foreigners may incorporate a Sdn Bhd as the sole director and shareholder, providing the following conditions are fulfilled:- 18 years old and above

- residing in Malaysia

- not disqualified under Section 198 of Companies Act 2016

However, if you are a foreigner who does not reside in Malaysia, you need at least 1 resident director to incorporate a Sdn Bhd. It is advisable to have a business partner based in Malaysia.

Shareholder

A Sdn Bhd can have up to 50 shareholders. During the company incorporation process, each shareholder will declare how many shares they hold. The value of each share is then determined where the total value of shares is equal to the total paid-up capital of the company. Once the company is incorporated and a business bank account is opened, each shareholder needs to transfer the amount into the business bank account according to the number of shares they hold.

Paid-up capital

The minimum paid-up capital to incorporate a Sdn Bhd is RM1. This paid-up capital declared during company registration can be changed later. Hence, it is advisable to cap the paid-up capital at RM10,000 and increase it when you have the fund after the company is incorporated. It is illegal to declare a paid-up capital amount that you do not have yet.

Documents needed

MyKad / Passport

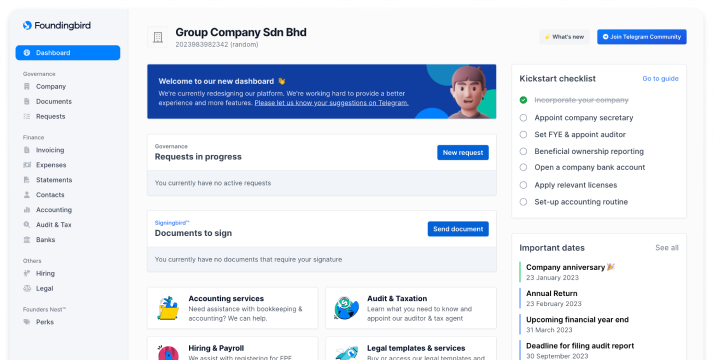

A requisite document in the process of incorporating a Sdn Bhd, the MyKad / Passport needs to be presented for identity validation purposes. If you decide to incorporate your company through the MyCoID portal, you are required to present your MyKad / Passport at the SSM counter when first creating an account on the portal. Otherwise, incorporating your company through a digital company secretarial firm like Foundingbird will require the validation of your MyKad / Passport via the e-KYC process for all directors and shareholders, without the need to present the document physically.

Authorisation letter for controlled words or trademark

In certain cases where the proposed company name contains controlled words or trademark, an authorisation letter from the respective authority or owner.

Payment needed

Charges by SSM

The SSM charges RM1,010 (inclusive of tax) of incorporation fee.

Charges by company secretary

If you engage with a company secretary to incorporate your Sdn Bhd, a service fee is charged for filling the application. Besides, a monthly fee is required to appoint a company secretary for your Sdn Bhd as required by the Companies Act 2016 to have a company secretary within 30 days of company incorporation. These charges can vary according to the pricing methods of different company secretarial firms.

Out of 8 types of business entities in Malaysia, Sdn Bhd is the most commonly registered company for entrepreneurs who want to start a business, especially when the Companies Act 2016 came into effect to simplify the mandatory compliances to form a private limited company. As the Malaysian government has taken initiatives to make company incorporation as easy as possible, entrepreneurs should not get bogged down by the traditional way of dealing with a company secretary which involves lots of paperwork and lengthy in-person appointments. Incorporating your Sdn Bhd should be a stepping stone to start your business, not a burden that costs you time and energy.

Table of Contents

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →