5 reasons to run your business under a Sdn Bhd in Malaysia

You don't always need to incorporate a Sdn Bhd to run a business in Malaysia. There is a total of 8 business entities in general with different requirements and each of them suits different business goals. However, Sdn Bhd is one of the most common business entities registered due to the benefits that it offers. These are 5 reasons to incorporate a Sdn Bhd as the business entity for your business.

To run a business as a foreigner residing in Malaysia

Foreigners have limited options when it comes to setting up a business entity to run a business in Malaysia. The incorporation of a Foreign Company is expensive as it requires a high share capital and high incorporation fee, so your best bet would be to incorporate a Sdn Bhd, or in other words, a private limited company. The requirements for a foreigner to incorporate a Sdn Bhd is the same as a Malaysian where only 1 director and shareholder (which can be the same person) is needed to form a Sdn Bhd. You only need to provide your proof of residency in Malaysia. However, you might not be allowed to run certain types of businesses according to the regulations of the local authorities.

To run a business in regulated industries

Manufacturing sector, construction sector, medical sector, oil & gas sector, finance sector, and telecommunication sector are some of the examples of regulated industries in Malaysia. Apart from registering your business entity with SSM, you might need to acquire a specific license from the respective governmental authority to operate your business legally. That often requires your business to be registered as a Sdn Bhd with a minimum paid-up capital; hence, it is recommended to check out the MalaysiaBiz portal for suggestions on the business licences that you need based on types of industries and locations of your business before deciding on which business entity to register.

To separate your personal liabilities from the business'

Your Sdn Bhd is a separate legal entity. Just like an independent individual, it can receive income, acquire properties, enter a contract with a third party, and be a part of legal actions. Even though you own the Sdn Bhd as a shareholder and manage it as a director, the Sdn Bhd itself bears responsibility for compliance matters and other day-in-day-out operations. Your personal wealth is protected should the business fail or suffer losses. For example, if your Sdn Bhd is sued by a company or an individual, they are only entitled for compensation based on the available funds and assets of the Sdn Bhd, not the personal assets of directors and shareholders. However, you can still be held responsible if you are found to be negligent towards your business.

To enjoy corporate tax benefits

If you are running your business as a Sole Proprietorship or a Partnership, there is no differentiation between personal income tax and taxes for your business; in other words, if your estimated annual profit is RM 150,000, this taxable business income of a Sole Proprietorship or a Partnership will be taxed at a personal income tax rate of 24% instead of the company tax rate of 17%. So, by running your business as a Sdn Bhd, the personal income tax rate only applies to the amount of salary you receive from your business while your company will pay the company tax rate for its taxable income each year.

To raise funds from investors

The options to raise funds for the expansion of a Sole Proprietorship or Partnership business are limited to only business loans from banks or P2P lending platforms. A Sdn Bhd allows you to raise funds through investments from equity crowdfunding platforms (ECF) or by selling shares in your company to individual and corporate investors. You can even differentiate ordinary shares and preference shares by adopting a constitution for your Sdn Bhd to outline the redeemability of shares and the voting rights of shareholders. Besides that, a Sdn Bhd has more credibility, for it is managed by a board of directors and is backed by shareholders who have contributed to the paid-up capital of the business, which gives you an extra advantage when raising funds from investors.

Knowing your business goals helps in choosing the right business entity for you. If you have decided to incorporate a Sdn Bhd, you can do it on your own through the MyCoID portal or engage the services of a company secretary. On the other hand, if you are currently running a Sole Proprietorship or Partnership and have plans to convert it into a Sdn Bhd once your business has grown, this comprehensive guide on converting your enterprise into a Sdn Bhd that lays out the requirements and processes of the transition will help you to better prepare your business when the time has come. Run your business the way you envision it to be.

Table of Contents

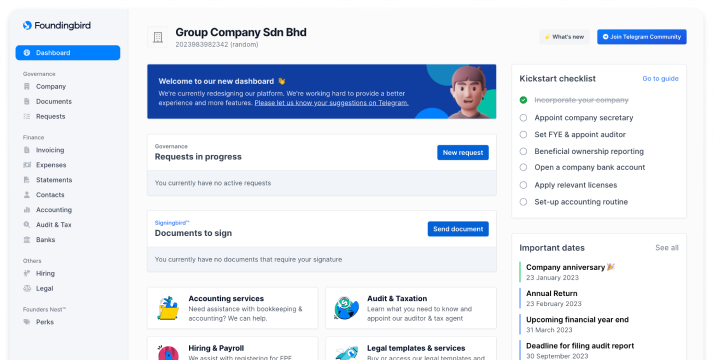

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →