The 8 Types of Business Entities in Malaysia: Which one should you choose?

Registering a business entity with the Companies Commission of Malaysia (SSM) is the first requirement to run a business legally in Malaysia. There are 3 categories of business entity registration, namely Registration of Business (ROB), Registration of Company (ROC), and Limited Liability of Partnership (LLP). These are regulated by different laws respectively, with a total of 8 business entities to choose from.

Comparison between different business entity registration categories:

| Category | Business Entities | Liability & Capital | Taxes |

| Registration of Business (ROB) | – Sole Proprietorship – Partnership | Unlimited personal liability. Capital from owner/partners. | Personal income tax |

| Registration of Company (ROC) | – Sdn Bhd – CLG – Sdn – Bhd – Foreign Company | Limited liability (separate legal entity). Share capital required (except CLG). | Corporate tax (except CLG) |

| Limited Liability Partnership (LLP) | – LLP | Limited liability (hybrid structure). Partner contributions. | Corporate tax |

1. Sole Proprietorship

A Sole Proprietorship is the simplest business entity to get started with if you are running your business alone at a small scale. You can register a Sole Proprietorship using your personal name at only RM30 or a trade name at RM60. The process of Sole Proprietorship registration has to be done on your own without going through a third party. As you are the only business owner, you bear all liabilities towards the business in your personal capacity and pays taxes through your personal income tax.

If you are considering converting your Sole Proprietorship into a Sdn Bhd in the future, request for this free guide on converting your enterprise into a Sdn Bhd. This guide covers most of your concerns about the requirements of company incorporation and its subsequent compliance with various laws and regulations, since Sdn Bhd companies are regulated more strictly by the Companies Commission of Malaysia (SSM) than other enterprises.

Who should register their business as a Sole Proprietorship?

Malaysians or permanent residents of Malaysia who want to start a small business alone.

Advantages of a Sole Proprietorship

- It is cheap to register.

- It has a simple registration process.

- It has simple compliance to follow.

Disadvantages of a Sole Proprietorship

- It has to be renewed annually.

- You bear all liabilities towards the business in your personal capacity.

- Your personal income tax can be expensive.

- It is difficult to scale since you are not able to issue shares to get investments.

💡 Planning to scale your business? A Sdn Bhd offers limited liability and better tax benefits. Compare with Sdn Bhd or learn how to convert later .

2. Partnership

A Partnership is a business entity that consists of at least 2 partners, with a limit of 20 partners. Similar to a sole proprietorship, partners of the partnership share the liabilities towards the business and pay taxes through personal income taxes. If your Partnership is sued by a customer, you and your partner(s) will be personally liable to any damages awarded by the court. This is a common business entity for professionals such as lawyers, accountants, company secretaries, doctors, etc.

If you are considering converting your Partnership into a Sdn Bhd in the future, request for this free guide on converting your enterprise into a Sdn Bhd. This guide covers most of your concerns about the requirements of company incorporation and its subsequent compliance with various laws and regulations, since Sdn Bhd companies are regulated more strictly by the Companies Commission of Malaysia (SSM) than other enterprises.

Who should register their business as a Partnership?

Malaysians or permanent residents of Malaysia who want to start a small business with business partners.

Advantages of a Partnership

- It is cheap to register.

- It has a simple registration process.

- It has simple compliance to follow.

- You can share the liabilities towards the business with your partners.

Disadvantages of a Partnership

- It has to be renewed annually.

- Your personal income tax can be expensive.

- It is difficult to scale since you are not able to issue shares to get investments.

💡 Protect your personal assets: A Sdn Bhd separates business liabilities from partners' personal wealth. See 5 reasons to incorporate a Sdn Bhd .

Comparison of business entities under ROB

| Business Entity | No. of business owners | Personal liabilities | Taxes |

| Sole Proprietorship | 1 | Not a separate legal entity, unlimited liabilities at personal capacity of business owners. | Personal income tax |

| Partnership | 2 – 20 (except for Partnership in professional practice) | Not a separate legal entity, unlimited liabilities at personal capacity shared among all the partners. | Personal income tax, shared among the partners |

3. Sendirian Berhad (Sdn Bhd) / Private Limited Company

A Sdn Bhd company is a private company limited by shares. It is a separate legal entity which is capable of earning incomes, owning properties, signing contracts, suing another entity, and getting sued on its own name, separating your liabilities from the company itself. Since the updates of the Companies Act 2016 came into effect, you can incorporate a Sdn Bhd as the only director and shareholder of the company without other business partners.

Who should incorporate their company as a Sdn Bhd?

Anyone who wants to run a SME business in Malaysia. The only restriction is, at least 1 director has to reside in the country.

Advantages of a Sdn Bhd

- It is relatively cheap to register.

- It has relatively simple compliance to follow.

- It separates your personal liabilities from the company itself.

- It is able to scale by increasing paid-up capital and issuing shares to investors.

- It can be 100% foreign-owned.

Disadvantages of a Sdn Bhd

- It is unable to expand beyond 50 shareholders.

- It is unable to raise funds from the public.

- The transfer of shares is restricted.

4. Company Limited by Guarantee (CLG)

A Company Limited by Guarantee is a public company without share capital for non-profit purposes. There are no shareholders, only members who act as guarantors to run the operation. You and other members do not contribute capital to the company but are responsible to pay debts if it closes down, according to the amount of guarantee as promised. Hence, it is unable to use its profits for purposes other than those stated as objectives in the constitution.

Who should register their company as a CLG?

Non-profit organisations.

Advantages of a CLG

- It requires no upfront capital contribution from members.

- It is the only business entity that can promote art, science, religion, charity and pension schemes.

- It can apply to get exempted from paying corporate taxes.

Disadvantages of a CLG

- It is costly and difficult to register.

- It has strict compliance to follow.

- All profits are used for the purpose of the organisation only.

- It is not allowed to release or own any property rights.

- It is unable to convert to other business entity.

- Members are still liable towards company debt if the company closes down within one year after they have left the company.

5. Sendirian (Sdn) / Unlimited Company

All companies limit the liability of its shareholders towards the company, except for a Sdn company. You can register a Sdn company to form a mutual fund that holds assets for investment purposes, rather than to carry out business. Since it has unlimited liability among its shareholders, it is similar to a Partnership with more flexibility in the ownership of shares where shareholders are free to sell their shares back to the company.

Who should register their company as a Sdn?

Mutual funds.

Advantages of a Sdn

- It has flexible ownership of shares.

- It can either be a private or public company.

Disadvantages of a Sdn

- It is costly and difficult to register.

- It has strict compliance to follow.

- Shareholders have full liability towards the company debts.

- Shareholders are still liable towards company debt if the company closes down within one year after they have left the company.

6. Berhad (Bhd) / Public Limited Company

Similar to a Sdn Bhd company, a Bhd company is a company limited by shares with a few differences - it can offer shares to the public without a limit on the number of shareholders, requires at least 2 directors and is governed by Bursa Malaysia Securities Berhad and the Security Commission of Malaysia. The registration of this business entity can be time-consuming and expensive due to strict compliance requirements. However, funding for the company would be easier to obtain since it is publicly listed on the market.

Who should register their company as a Bhd?

Entrepreneurs with large business models.

Advantages of a Bhd

- It is easier to raise funds as the company is listed.

- It is able to raise funds from the public by issuing shares.

- It has flexible ownership of shares.

Disadvantages of a Bhd

- It is costly and difficult to register.

- It has strict compliance to follow.

7. Foreign Company

A Foreign Company is for non-Malaysians who have established businesses in other countries and want to set up a company branch in Malaysia for operation or customer service purposes. This allows foreigners to run businesses in Malaysia without having a director that resides in the country. Non-Malaysians who are not permanent residents have limited options in registering a business entity in Malaysia. You can only opt for either a Sdn Bhd company or a Foreign Company.

Who should register their company as a Foreign Company?

Foreigners with established businesses in other countries who want to start a branch in Malaysia.

Advantages of a Foreign Company

Non-Malaysians can operate a business in Malaysia without a local director.

Disadvantages of a Foreign Company

- It is costly and difficult to register.

- It has strict compliance to follow.

- It is unable to raise funds from the public.

Comparison of business entities under ROC

| Business entity | No. of business owner | Personal liabilities |

| Sdn Bhd (Private Limited Company) | 1 – 50 shareholders | Company's liabilities separated from the directors' and shareholders'. |

| Company Limited by Guarantee (CLG) | Only members | Members are liable according to the amount of guarantee as promised. |

| Sdn (Unlimited Company) | 1 – 50 shareholders | Shareholders have unlimited liabilities at personal capactiy. |

| Bhd (Public Limited Company) | Unlimited shareholders | Company's liabilities separated from the directors' and shareholders'. |

| Foreign Company | 1 – 50 shareholders | Company's liabilities separated from the directors' and shareholders'. |

8. Perkongsian Liabiliti Terhad (PLT) / Limited Liability Partnership (LLP)

Unlike other business entities, a LLP is governed under the Limited Liability Partnerships Act 2012 which was newly introduced in Malaysia in 2012. It is a combination of a Sdn Bhd company and a Partnership with some differences such as there must be at least 2 partners, with no maximum number of partners you can have in the business. Because LLP is still relatively new, it is not commonly registered in Malaysia.

Who should register their company as a LLP?

Malaysians or permanent residents of Malaysia who want to start a small business with business partners.

Advantages of a LLP

- It has no maximum limit on the number of partners.

- It is relatively cheap to set up.

- It has flexible agreement among partners.

Disadvantages of a LLP

- It is unable to raise funds from the public.

- It is governed by a relatively new law, which could be confusing.

Comparison of LLP and partnership

| Business Entity | No. of Business Owners | Personal Liabilities | Taxes |

| LLP | Minimum 2, with no maximum limit | A separate legal entity, with company's liabilities separated from the directors' and shareholders'. | Corporate Tax |

| Partnership | 2 – 20 partners (except for Partnership in professional practice) | Not a separate legal entity, unlimited liabilities at personal capacity among all the partners. | Personal income tax, shared among the partners |

Deciding on the most suitable business entity to register gives you an upper hand in getting started with businesses legally in Malaysia. Bear in mind even though you may enjoy more financial security when running your business as a company, all companies incorporated are required to fulfil mandatory obligations, such as getting a company secretary (in place of a company secretary, an agent for Foreign Companies and a compliance officer for PLT companies), lodging annual returns, and filing taxes. Hence, it is crucial to weight the pros and cons of each business entity in advance to make the most out of the process.

Table of Contents

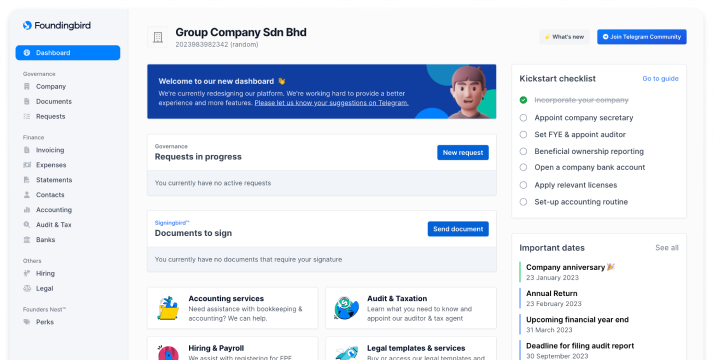

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll