When to hire a corporate lawyer for your business in Malaysia

There is a common misconception towards hiring corporate lawyers in Malaysia when it comes to the legal compliance needs of your entrepreneurial journey — corporate lawyers are often deemed expensive as they charge you for every hour you talk to them. Business owners are often reluctant to spend on legal fees unless it turns out to be absolutely necessary, usually when things have gone down the drain. You might think that it is sufficient to 'consult' Google for your normal business legal needs but it is advisable to hire a good corporate lawyer as early as possible, especially when your business falls under the following situations.

When your business is in a regulated industry

In order to legally carry out a business in one of the regulated industries, you need to apply for licences from the respective government authority and be compliant with the regulations in place. A corporate lawyer can advise you on the laws you should be aware of, besides navigating the legal landscape of the particular industry.Examples of regulated industries in Malaysia are - manufacturing sector, construction sector, medical sector, finance sector, telecommunication sector, etc. Even if you are starting a tech company, if your business model involves any of the regulated industries, chances are you may need to get the same regulatory approvals too.

Risk of closedown without the necessary licence

In the year 2018, a fintech company in Malaysia was ordered to cease operations because it did not obtain the necessary licence from the Securities Commission of Malaysia (SC), a regulator in charge of protecting the investors and regulating the capital market. Despite having obtained a customer base in the country, the 'cease and desist' letter has made it clear that without the licence from the regulatory authority, a business is prohibited from operating.Application for business licences seems like a hassle, especially when your business is disruptive to the industry with no existing market players acting as precedent. However, regulators around the world have realised the importance of innovation. In fact, many regulatory agencies have formed dedicated teams to focus on handling new emerging technologies and are open to access new business models. For example, Bank Negara Malaysia (BNM) has established the Financial Technology Enabler Group (FTEG) which is dedicated to fintech companies seeking to set up operations in Malaysia that may fall within the purview of BNM while SC has launched the aFINity@SC initiative to attract greater participation from the industry to facilitate the development of the digital finance and technology sector in Malaysia.

A corporate lawyer with direct experience in dealing with the regulators can help you pinpoint sticky issues that regulators tend to focus on so that you can get prepared before the consultation meeting with the regulator’s team. It is best to work out specific details of the regulations that need to be satisfied as an applicant to save time and to ensure a smoother application process. In short, it is necessary to get advice on your business model and licence application from a corporate lawyer before launching your business in the market.

When you have co-founders or other shareholders

Having co-founders and shareholders is a boost to your business especially at the early stages. To prevent fraud and potential conflicts from arising in the future, you can engage a lawyer to outline the rights and responsibilities of various stakeholders in a co-founder or shareholder agreement.It is advisable to be prepared for several possible outcomes for the business, such as if one of the co-founders decides to leave, the business goes bankrupt, or how to divide the profits if the business manages to exit.

Conflicts are bound to happen even in the best relationships

According to the Startup Genome Report Extra on Premature Scaling, over 90% of startups fail due to internal issues rather than competition. Many entrepreneurs get together and start a business together without discussing the 'hard' issues for the sake of preserving peace and cordiality among co-founders.One of the worst decisions made for the business which can lead to a 'deadlock' conflict is to split the equity equally among co-founders. While it sounds fair to share the business with your co-founder at a 50/50 split, without a pre-agreed mechanism on resolving disagreements between co-founders, the business is bound to get into a standstill.

A good corporate lawyer can ask the difficult questions that can affect the final decisions on equity ownership structure in a company. Customarily, in a newly started business, a corporate lawyer is engaged to help prepare the founders agreement / shareholders agreement. In other words, the lawyer is acting as a neutral party and does not favour any specific shareholder in the company. A lawyer will ask all co-founders in the business on their expectations between competing interests of other co-founders so that all everyone is clear on their respective contributions to the business. Here are some questions that should be discussed among the co-founders of a business.

- How much commitments in terms of time and knowledge will each co-founder spend on the business?

- How should decisions be made if the co-founders disagree, such as if there is a new investment opportunity but one of the co-founders does not like the investment offer?

- What happens if one of the co-founders decides to leave the business 3 - 6 months after the business was started? Are you or other co-founders able to take over the shares of the leaving co-founder?

- Can a co-founder sell their shares to someone else at any point of the time?

All these questions can be answered through a well-drafted shareholders agreement, which is also known as a founders agreement or partnership agreement. A shareholders agreement outlines customary and commercial terms such as the composition of the board members, voting mechanism and threshold, conditions on transferring and issuance of shares, and reserved matters. These terms vary according to the different concerns or priorities of co-founders. Hence, no two shareholders agreement are the same. It is recommended to engage a corporate lawyer to finalise the shareholders agreement to make sure all bases are covered.

When you want to raise funds for the business

Raising funds from investors for your business is a big deal. You want to have a fair transaction with investors while having your rights protected. A lawyer can explain to you the commercial terms stated in the investment term sheet you receive so that you understand your position in the potential investment before signing any agreement. You can get their advice on how to negotiate with the investors for an outcome that you prefer.

Fundraising is a regulated activity

You might not be aware that fundraising is a regulated activity under the Capital Markets and Services Act 2007 (CMSA) that is regulated by the SC in Malaysia. Only public companies can raise funds from the public through an initial public offering (IPO), while unlisted public companies have to issue a prospectus in order to offer shares to the public.Strictly speaking, private companies like a Sdn Bhd are not allowed to raise money from the general public. As a business owner, you may only raise funds through a closed-door session, such as asking a friend to become a shareholder for the company. Otherwise, they can also raise funds from the public through equity crowdfunding platforms (ECFs) that are licensed by the SC.

A corporate lawyer who has acted in fundraising exercises can guide you through the customary steps that need to be done. If you are raising funds from sophisticated investors (angel investors, high net worth individuals, etc.) or institutional investors (accelerators, venture capitals, etc.), a corporate lawyer can go through the investment term sheet with you to point out if the terms are of industry standards or are uncommon for the specific fundraising round that you are involved with. Besides, the corporate lawyer can help you with the necessary paperwork to make sure that the shares purchased by the investors are properly issued by the company secretary. This can prevent problems in fundraising rounds in the future if the shares have not been issued properly earlier on.

When your business wants to have a partnership with another company

Agreements for collaborations between 2 or more companies are not just a signed template to officiate the collaboration. It serves the purpose of protecting the rights of all parties involved and indemnity against the worst-case scenario. Whether it is a strategic partnership agreement or a reseller agreement, a lawyer can draft the agreement based on your business needs and make sure that your rights are protected if the agreement is provided by the other party.

Managing expectations through legal agreements

Similar to a shareholders agreement, having a legal agreement between 2 companies is essential in laying out expectations for this collaboration. Usually, both companies who are entering into a contract should have their own legal representation to make sure their rights are protected.One common commercial issue surrounding a technology transaction is about intellectual property ownership. If you are providing your technology through the collaboration, you need to be clear on the ownership of the intangible assets created during the collaboration. A good agreement drafted by a corporate lawyer will set out the IP ownership issues head-on so that there will be no dispute in the future. Besides, a corporate lawyer will help you list out the scope of services so that there will be little ambiguity as to the expected deliverables on your side to reduce potential conflict or even termination of the agreement due to an unintentional breach of contract. In addition, the corporate lawyer can include a good clause that helps you 'transition' the termination in a smooth manner so that your business can 'exit' and move on to the next deal.

When you are hiring employees or contractors

Employees and contractors are a great help for your business but they come and go. Having a proper employment or contractor agreement prepared by a lawyer can protect your Intellectual Property (IP) and confidential information of your business in cases where the employees or contractors leave. Besides, the corporate lawyer can point out clauses that are not enforceable in the agreement so that you can focus on clauses that matter.

Protect any confidential information of your business

Whether you are engaging an independent contractor to build your first minimum viable product (MVP) or an employee who is paid a monthly salary, a confidentiality and assignment agreement must be signed. This agreement ensures that any confidential information of the business, such as customers' data, proprietary business structure, and process flows, are not allowed to be disclosed to any third party without the company's prior consent. Besides, the agreement can clearly lay out that all the intellectual assets created by the contractors or employees for your business are legally owned by your company. It is illegal for them to secretly sell the intellectual assets to a third party even though they are the one who created them.

Everything is fine until it is not. Laying out a strong legal foundation for your business since the beginning is important to ensure that your business is well protected and does not risk falling into a costly legal pitfall. Consult a lawyer if you have doubts in each step you are taking when running your business. Get the professional help your business needs.

Special thanks to Izwan Zakaria for this content collaboration! Izwan Zakaria is the managing partner of Izwan & Partners, a corporate, technology, and venture capital law firm. He is also the author of The Startup Law Blog, a website covering legal topics and trends affecting technology entrepreneurs and startups in Malaysia. He can be contacted on Twitter at @izwanzakaria1 or email at izwan@izwanpartners.com.

Table of Contents

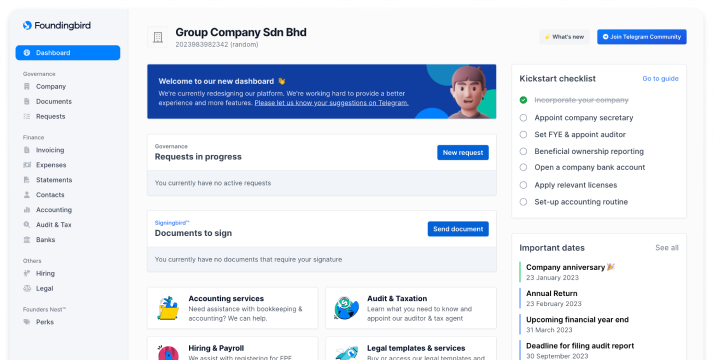

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

The 8 Types of Business Entities in Malaysia: Which one should you choose?

Complete guide to choosing the right business entity in Malaysia. Compare Sdn Bhd, sole proprietorship, partnership, LLP & more. Includes registration costs, tax implications & requirements for 2026.

Read more →