Form 9? S17? - Know the statutory forms of your Sdn Bhd

Whether you are opening a business bank account or applying for a payment gateway service for your e-commerce website, you will be required to provide some statutory documents of your company. The required documents are usually given a 'code word' - F9, F13, F24, F32A, etc. that might not make sense to the general public. In fact, if your company has been incorporated after the year 2016, these document names that start with the letter 'F' are not relevant to your company as per the updates in the Companies Act 2016.

The SSM has published a detailed explanation in the introduction of the Companies Act 2016. You can check out the clarifications on the old and new statutory documents which are listed in Schedule A, B, and C together with attached sample documents. Here's a summary of some essential statutory documents of your company that you should know.

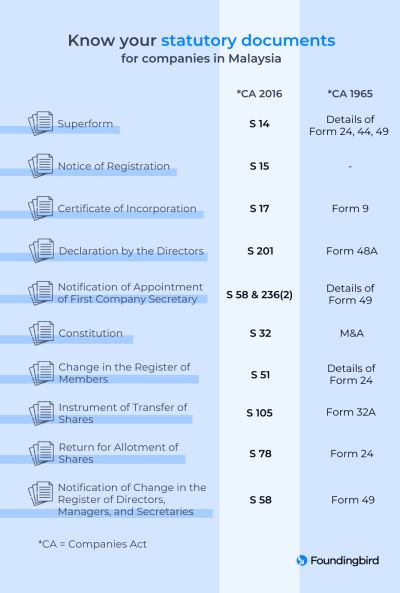

Quick Reference: Old Forms vs New Forms

The Companies Act 2016 introduced new statutory form codes to replace the old form numbers. If your company was incorporated before 2016, your documents may still use the old form names (F9, F24, F49, etc.). Companies incorporated after 2016 will have the new form codes (S14, S15, S17, etc.). Both versions are legally valid - use the table below to find the equivalent form you need.

| New Form | Old Form | Purpose |

|---|---|---|

| S14 | F24, F44, F49 | Superform (incorporation details) |

| S15 | - | Notice of Registration |

| S17 | F9 | Certificate of Incorporation |

| S201 | F48A | Director Declaration |

| S58&236(2) | Part of F49 | First Company Secretary Appointment |

| S32 / Constitution | M&A | Constitution |

| S51 | Part of F24 | Shareholder Changes |

| S78 | F24 | Share Allotment |

| S58 | F49 | Director/Secretary Changes |

| S105 | F32A | Share Transfer |

Application for Registration (Superform) - S14

Previously known as Form 24, Form 44, and Form 49.The Application for Registration, more commonly known as the Superform, is issued right after your company has been incorporated. This document states all basic information of the company such as:

- Company name and type.

- Business nature and description.

- Particulars of directors and shareholders.

- Information of the person who submitted the incorporation application.

If you need the latest information on the company, it might be best to obtain the company profile from the MyDATA or e-Info portal.

Notice of Registration - S15

Did not exist previously.Upon the approval of your company incorporation, the SSM will inform the person who submitted the company incorporation application (who is also known as the 'lodger'), whether it is yourself or your company secretary, through an email. This email is known as the Notice of Registration.

The Notice of Registration is the official notice from the SSM on successful company incorporation.

Certificate of Incorporation - S17

Previously known as Form 9.The Certificate of Incorporation will not be issued automatically after your company is incorporated, the SSM will email you the Notice of Registration (S15) instead. However, this document is still a requirement for many organisations such as banks and financial service providers as proof of incorporation.

You can purchase this document through the MyDATA or e-Info portal.

Declaration by Person before Appointment as Director - S201

Previously known as Form 48A.The Declaration by Person before Appointment as Director is signed individually by all directors before the company incorporation application is submitted to declare that they have met the requirements to act as director and have given consent to the appointment.

Notification of Appointment of First Company Secretary - S58&236(2)

Was previously included in Form 49.Notification of Appointment of First Company Secretary is only submitted once when the first company secretary is appointed within 30 days of the company incorporation. It is to confirm the appointment of the first company secretary for your company.

Lodgement of Constitution - S32

Previously known as Memorandum and Articles of Association (M&A).The adoption of a constitution is not mandatory for Sdn Bhd since the provisions of the Companies Act 2016 and the Third Schedule can be adopted in place of the constitution. Despite this, there are still organisations that request this document to ensure that the company's, shareholders', and directors' power are documented. In such cases, you will need to explain to them that your company does not adopt a constitution.

Even though the adoption of a constitution is no longer mandatory for private limited companies, you are still advised to adopt one under certain situations to grant your company more flexibility in terms of decision making and governance.

Notification of Change in the Register of Members - S51

Was previously part of Form 24.S51 is a document that shows the changes to the shareholding of the company. It is submitted by the company secretary whenever there are changes towards the shareholding of the company. As such, there can be many S51 documents throughout the lifespan of your company.

However, if there are no changes in shareholders since the company incorporation, your company will not have this document. You can provide the Superform to show the shareholders information. On the other hand, if there are changes in shareholders, this document should be provided alongside the Superform even though only the Superform is requested.

Return for Allotment of Shares - S78

Previously known as Form 24.S78 is issued once new shares are allotted. It states the information of the new shareholder, the type and class of share issued, and the number of shares issued with its price. After this document is submitted, the company secretary will submit the Notification of change in the Register of Members (S51).

Notification of Change in the Register of Directors, Managers, and Secretaries - S58

Previously known as Form 49.Each time there are changes in managers, directors or company secretaries of the company, S58 should be submitted to the SSM. Similar to the Notification of Change in the Register of Members, your company can have many S58 documents throughout its lifespan; hence, they should be provided alongside the Superform even though only the Superform is requested.

Instrument of Transfer of Shares - S105

Previously known as Form 32A.This is an agreement between the transferor and transferee regarding the transfer of shares in the company. It lays out the number of shares, price of the shares, and other details. Once signed, this document is stamped at the LHDN.

Once the shares have been transferred, the company secretary will submit the Notification of Change in the Register of Members (S51) to update the latest shareholding of the company.

Sample documents attached in this article have been taken from the SSM website as well as the MyDATA portal. Except for the Notification of Registration and Certificate of Incorporation that are issued by the SSM, other statutory documents should be prepared by the company secretary and submitted to the SSM. Once the SSM has accepted and approved the documents, they will be uploaded onto the MyDATA and e-Info portals. So, you can either purchase the statutory documents from those portals in the form of digitally certified true copies (CTCs) or request for them to be provided and certified by your company secretary. Since some of the statutory documents might require other supportive documents to be valid, it is best to inform your company secretary of the reasons for requesting the documents so that they can provide the complete set of statutory documents that you need.

Frequently Asked Questions

Where can I get my company's S14 (Superform)?

The S14 Superform is only issued once during incorporation. If you need a copy, you can purchase it from the MyDATA or e-Info portal, or request a certified copy from your company secretary.How much does S17 (Certificate of Incorporation) cost?

The S17 Certificate of Incorporation can be purchased from the MyDATA or e-Info portal. The SSM charges a prescribed fee for this document. Contact your company secretary if you need assistance obtaining it.What is the difference between S51 and S58?

S51 records changes in shareholding (shareholders/members), while S58 records changes in directors, managers, and company secretaries. Both documents may need to be provided together with your Superform when requested by third parties.Do I need a constitution (S32) for my Sdn Bhd?

No, a constitution is not mandatory under the Companies Act 2016. However, some organisations may request it. If your company does not have a constitution, you can explain that your company operates under the provisions of the Companies Act 2016 and the Third Schedule instead.What documents do I need for opening a business bank account?

Banks typically require the S14 (Superform), S17 (Certificate of Incorporation), and may ask for S51 and S58 if there have been changes since incorporation. It is best to check with your bank and inform your company secretary so they can provide the complete set of documents.Need help with your company documents?

If you need assistance obtaining statutory documents or have questions about your company's compliance, Foundingbird's company secretary services can help. Our team can provide certified copies of your documents and ensure your company stays compliant with SSM requirements.

Table of Contents

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Related Articles

Enterprise vs Sdn Bhd in Malaysia: Which Should You Choose? (2026 Update)

Compare Enterprise (Sole Proprietorship) vs Sdn Bhd in Malaysia. See 2026 tax rates, setup costs, e-invoicing requirements, and which business structure is right for you.

Read more →