4 ways Budget 2021 might benefit SMEs in Malaysia

With the theme ‘Stand United, We Shall Prevail’, Budget 2021 was planned based on 3 goals — Rakyat’s well-being, business continuity, and economic resilience, in line with the Revitalise stage of the 6R economic recovery plan. Unlike previous Budgets, the preparation of Budget 2021 involves more than 38 dialogues across 40 businesses and industries, and budget consultations covering all 14 states. Despite this unprecedented pandemic crisis, our country’s economy is expected to recover and expand at a rate of 6.5 to 7.5%. These are the 4 ways Budget 2021 might benefit your SMEs' businesses.

Empower entrepreneurs and businesses

Several initiatives have been planned to assist specific groups of entrepreneurs and SMEs in Malaysia.For Bumiputera entrepreneurs

A total of RM4.6 billion will be allocated to boost and empower Bumiputera entrepreneurs through the following programmes:- TEKUN and Perbadanan Usahawan Nasional Berhad (PUNB) for the financing of Bumiputera SMEs and micro-SMEs worth RM510 million.

- Capacity building programmes by Bank Pembangunan Malaysia (BPMB) and SME Bank worth RM800 million.

- Syarikat Jaminan Pembiayaan Perniagaan (SJPP) for the financing of Bumiputera SMEs through worth RM2 billion.

- Various capacity building programmes, including professional development, DanaKemakmuran Bumiputera, worth RM1.3 billion.

For women entrepreneurs

To value the contribution of women and to enhance their role in nation-building, the government has come out with several initiatives.- A special micro-credit financing of RM95 million will be provided through TEKUN, MARA, and Agrobank.

- Support towards Islamic pawnbroking worth RM50 million through Ar-Rahnu BizNita of the Islamic Economic Development Foundation (YaPEIM) .

- Business technical guidance and training programmes especially in marketing, labelling, and packaging will be given to more than 2,000 women entrepreneurs under the Micro Entrepreneurs Business Development Programme (BizMe).

- An allocation of RM30 million for the establishment of childcare centres in government buildings to support frontliners and working women. Besides this, a matching grant of up to RM20 million will be provided to entrepreneurs towards establishing childcare centres for their employees.

For communities

TEKUN will provide RM20 million for the Skim Pembangunan Usahawan MasyarakatIndia (SPUMI) and RM5 million for the entrepreneurship development of other minority communities.For social enterprises

Malaysian Global Innovation and Creativity Centre (MaGIC) and selected agencies have been allocated RM20 million to conduct social enterprise development programmes. Besides that, social enterprises can supply goods and services valued up to RM20 million per year to the government by becoming suppliers with the Government Impact e-Procurement Program Certificate.For digitalisation and automation in businesses

- The Industrial Digitalisation Transformation Scheme provided by BPMB that is worth RM1 billion and aims to boost digitalisation activities has been extended until 31 December 2023.

- The SME Digitalisation Grant Scheme and the Smart Automation Grant will be provided with an additional fund of RM150 million. The eligibility conditions for these grants have been relaxed for micro SMEs that have been operating for at least 6 months.

Drive investments to key sectors

The government will facilitate the strengthening and growth of key sectors through several initiatives.For high value-added technology and innovative companies

2 funds will be provided to support high technology and innovative companies:- A special incentive package worth RM1 billion that aims to support R&D investment inaerospace and electronic manufacturing based in Batu Kawan, Penang and Kulim, Kedah industrial parks.

- A High Technology Fund worth RM500 million provided by Bank Negara Malaysia (BNM) that enables Malaysia to remain competitive in the global supply chain.

For high-value service activities

- Relaxation of tax incentive conditions for the Principal Hub, with the incentive extended until 31 December 2022.

- New tax incentive for the establishment of Global Trading Centre at a concessionary rate of 10% for a period of 5 years. It is renewable for a period of another 5 years.

- Increase of limit on the sales value for value-added and additional activities carried out in the Free Industrial Zone and Licensed Manufacturing Warehouse from 10% to 40% of the total annual sales value.

- Special income tax treatment for non-resident individuals holding key positions in companies relocating their operations to Malaysia under the PENJANA incentive package at a flat rate of 15% for a period of 5 years.

- Application for the special corporate tax rate for selected manufacturing companies which have relocated their businesses to Malaysia has been extended for another 1 year until 31 December 2022. The scope of tax incentives will also be extended to companies in the selected services sector which have a significant multiplier effect by providing a corporate tax rate of 0% to 10% for a period of 10 years.

For locally manufactured products

- The Micro Franchise Development and Affordable Franchise programmes, as well as Buy Made in Malaysia programme, with an allocation of RM25 million.

- The e-Commerce SME and Micro SME Campaign, with an allocation of RM150 million, provides training programmes, sales assistance, and digital equipment for 100,000 local entrepreneurs to encourage adoption of e-commerce.

- The implementation of the Shop Malaysia Online initiative together with the e-commerce platform to encourage online spending which will benefit 500,000 local sellers, with an allocation of RM150 million.

- The promotion of Malaysian-made products and services under the Trade and Investment Mission with an allocation of RM35 million.

For medical and pharmaceutical products

- The Ministry of Health's Off-Take Agreement Programme will be strengthened to enable Malaysia to become an investment destination especially for locally produced vaccines, medicines, and medical devices.

- Preferential tax rate of 0% to 10% for a period of 10 years for manufacturers of pharmaceutical products, including vaccines, to invest in Malaysia.

For the agriculture sector and food industry

- The Agrofood Value Chain Modernization Programme with funding of up to RM1 millionat a rate of 3.5% for a period of 10 years for the procurement of equipment and technology based on IR4.0. Besides this, Agrobank will provide RM60 million for this purpose.

- The implementation of Aquaculture Development Programme with an allocation of RM10 million through matching grants of up to RM20 thousand for micro-entrepreneurs to purchase equipment to develop high-value aquaculture livestock.

- The implementation of impactful and high-value farming projects with an allocation of RM100 million through collaboration with State governments such as pineapple farming in Johor andfreshwater prawns in Negeri Sembilan.

For the commodity sector

- The continuance of Malaysian Sustainable Palm Oil Certification (MSPO) with an allocation of RM20 million to boost growth and enhance the competitiveness of the country's palm oil industry. Besides that, a matching grant of RM30 million will also be introduced to encourage the industry's investment in mechanisation and automation.

- An incentive of RM16 million for latex production to encourage latex production, rather than cuplump production, that will be started in Pahang, Terengganu, and Kelantan.

- The opening of a furniture industrial park in Pagoh to further boost the timber industry.

- A fund of RM500 million for the Forest Plantation Development Loan (PPLH) programme under the 12th Malaysia Plan, for the development of forest plantations with an area of 4 hectares and above.

For the tourism sector

- A total of RM50 million will be provided for the maintenance and repair of tourism facilities throughout the country. Besides this, an allocation of RM20 million will be provided to improve the infrastructure and intensify the promotion of Cultural Villages in Terengganu, Melaka, Sarawak and Negeri Sembilan.

- The Malaysia Healthcare Travel Council will receive an allocation of RM35 million to enhance the competitiveness of the local health tourism industry. Besides this, income tax exemption for the export of private healthcare services will be extended until the year of assessment 2022.

- A PRIHATIN Special Grant of RM1,000 for traders, hawkers, and drivers in Sabah.

- An exemption from the Human Resources Development Fund (HRDF) levies will be given for 6 months, starting from 1 January 2021, covering the tourism sector and companies affected by the pandemic.

For other sectors

- A National Development Scheme (NDS) valued at RM1.4 billion by BPMB will be introduced to support the implementation and development of domestic supply chain and increase the production of local products such as medical devices.

- The Maritime Development and Logistics Scheme, Sustainable Development Financing Scheme, Tourism Infrastructure Scheme, and Public Transport Fund will be extended until 31 December 2023, with a fund size of RM3.7 billion.

Improve access to financing

This is to help SMEs and micro SME entrepreneurs who have difficulty obtaining funds.Micro credit financing

- SME Bank will provide a total fund of RM300 million through the Lestari Bumi financing facility scheme to encourage the development of Bumiputera micro and small businesses.

- The National Supply Chain Finance Platform, JanaNiaga, lead by EXIM Bank will provide financial assistance worth RM300 million to SMEs that supply to the government or GLCs.

- Peer-to-peer financing (P2P), especially those based on invoice financing, will be provided, with RM50 million based on a matching investments basis.

- TEKUN, PUNB, Agrobank, BSN, and other financial institutions will provide micro credit financing worth nearly RM1.2 billion, including RM 110 million allocated to Micro Enterprises Facility managed by BNM to encourage entrepreneurship among freelancers and self-employed, besides supporting the iTEKAD programme.

- The iTEKAD program will be expanded through the participation of additional financial institutions and collaboration with more state religious authorities and delivery partners.

- PUNB will provide financing worth RM230 million SMEs for working capital, upgrading of automation systems and equipment, and expenditure related to the implementation of COVID-19 SOP compliance.

Targeted Assistance and Rehabilitation facility

The BNM will assist SMEs affected by the pandemic through the Targeted Assistance and Rehabilitation facility worth RM2 billion ringgit through loans from banking institutions.Loan guarantees

- The SJPP will have an increased guarantee to up to another RM10 billion, with RM2 billion reserved for Bumiputera entrepreneurs.

- The Danajamin Prihatin Guarantee Scheme that has been extended until 2021 will be allocated a guarantee of RM3 billion, with improved terms and conditions for corporate companies involved in highly skilled industries such as oil and gas, as well as aerospace.

Alternative financing

- Income tax exemption of 50% of the investment amount or up to RM50 thousand will be given for individual investors who take part in financing through the Equity Crowdfunding (ECF) platforms.

- RM30 million ringgit will be allocated through matching grants to be invested on ECF platforms.

Ease the burden of loan repayment

The Targeted Loan Repayment Assistance (TRA), which started in October 2020, will be will be enhanced for micro-enterprises with loans of up to RM150,000. Borrowers have 2 options:- Get a moratorium on the installments for a period of 3 months.

- Reduce the monthly repayment by 50% for a period of 6 months.

Encourage hiring and employment

Initiatives designed to generate new jobs and retain existing employees.Hire through PenjanaKerjaya

A total of RM2,000,000 has been allocated for several enhancement of the existing hiring incentive and training programme – PenjanaKerjaya run by SOCSO that was made to encourage employers to hire employees for their businesses. This incentive will be given for a period of 6 months.- The incentive provided for you if you hire a worker has been enhanced from a flat rate of RM800 per month to 40% of the worker’s monthly wages, capped at RM4,000. This is for employees earning RM1,500 and above.

- You will be given an additional incentive equivalent to 20% of the employee�s monthly wages, making the total incentive to employers� amount to 60%, if you hire the disabled, long-term unemployed, and retrenched workers.

- For sectors such as construction and plantations where there is a high reliance on foreign workers, you will get a special incentive of 40% from the total of 60% of monthly wages if you hire local workers to replace the foreign workers.

- The maximum training rate which you can claim for the training of those employed under the PenjanaKerjaya will be increased from RM4,000 to RM7,000 for high skilled training and professional certifications.

Employ youth for apprentices

- For each new graduate employed by private employers in the apprenticeship programme, an incentive of RM1,000 per month for up to 3 months will be provided.

- A grant of up to RM4,000 can be claimed for training provided to apprentices, through an allocation of RM250 million.

Provide employment opportunities for ex-convicts and former drug addicts

Further tax deduction on remuneration given to employers who employ ex-convicts, parolees, supervised persons and ex-drug dependants has been extended until the year of assessment 2025.Extend the Wage Subsidy Programme for targeted sectors

The existing Wage Subsidy Programme by SOCSO, which was supposed to end in December 2020, has been extended for another 3 months, specifically for the tourism and retail sector. A total of RM1,500,000 has been allocated to this programme to help about 70,000 employers. Each employee earning RM4,000 and below will get RM600 a month. The limit of 200 employees per company has been increased to 500 employees.Although our economy has taken a hit due to the pandemic, many opportunities have arisen in the midst of chaos, especially in the fields of public health, e-commerce, logistics, and education technology. Now is the perfect time for businesses to capitalise on the opportunities provided in light of Budget 2021. Businesses should leverage on present opportunities and pivot accordingly to adapt to the new norm.

Table of Contents

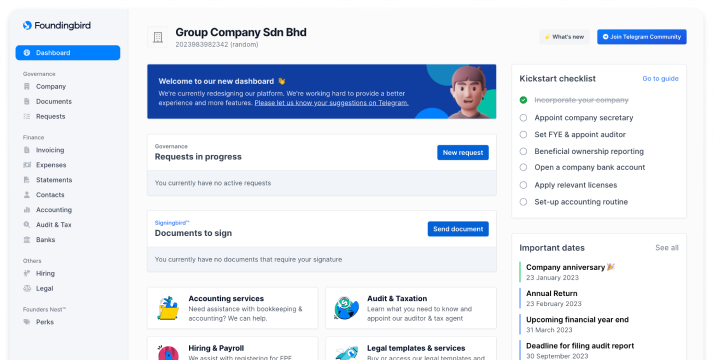

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll