14 Economic Stimulus Packages for Malaysian SMEs (updated)

In order to combat the economic impact of the COVID-19 pandemic towards the people, Malaysian prime minister, Tan Sri Muhyiddin Yassin, has introduced the PRIHATIN Rakyat Economic Stimulus Package on 27 March 2020. Out of the total value of RM250 billion, RM100 billion has been allocated for businesses including small and medium enterprises (SMEs) and RM2 billion has been allocated to strengthen the economy. On 6 April 2020, an additional RM10 billion was allocated to reduce the financial burden of SMEs and to ensure job retention of 2/3 employees in this country.

Additional fund in 5 key initiatives

An additional fund of RM4.5 billion has been provided by the government and Bank Negara Malaysia to cover the following 5 existing key initiatives:

1. Special Relief Facility (SRF)

RM3 billion has been added to the existing RM2 billion fund of Special Relief Facility (SRF) to help alleviate the immediate and targeted cash flow problems faced by SMEs for the sustainability of business operations and the safeguarding of jobs.

Benefits of SRF

- Loan of up to RM1 million per SME for a maximum period of 5.5 years.

- No collateral is required.

- A grace period of 6 months, where no repayment is needed within this period.

- The maximum financing rate is lowered from 3.75% per annum to 3.5% per annum.

Eligibility for SRF

Subject to assessment by the participating financial institutions (PFIs).

Applicable period for SRF

Until 31st December 2020.

How to apply for SRF

Apply directly to any PFI. Some PFIs are listed below:2. All Economic Sectors (AES) Facility

RM1 billion has been added to the existing RM5.8 billion fund of All Economic Sectors (AES) Facility to enhance access to financing for SMEs and to support growth in all economic sectors, such as agriculture, manufacturing (including agro-based) and services.

Benefits of AES Facility

- Loan of up to RM5 million per SME for a maximum period of 5 years.

- A grace period of 6 months, where no repayment is needed within this period.

- The maximum financing rate is lowered from 8% per annum to 7% per annum.

Eligibility for AES Facility application

Subject to assessment by the PFIs.

Applicable period for AES Facility

Open

How to apply for AES Facility

Apply directly to any PFI. Some PFIs are listed below:3. Micro Credit Scheme

RM500 million has been allocated to the Micro Credit Scheme administered by Bank Simpanan Nasional, bringing the total value to RM700 million for all micro-entrepreneurs in all business sectors. The interest rate has been lowered to 0% instead of 2% as announced earlier.

Benefits of Micro Credit Scheme

- Loan of up to RM75,000 per entrepreneur with an interest rate of 0% for a maximum period of 5.5 years.

- No collateral is required.

- A grace period of 6 months, where no repayment is needed within this period.

- The maximum financing rate is lowered from 8% per annum to 7% per annum.

Eligibility for Micro Credit Scheme application

- Micro-enterprises affected by the COVID-19 pandemic.

- Malaysian-owned business.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

- Business in operation for at least 6 months.

Applicable period for Micro Credit Scheme

Until 31st December 2020.

How to apply for Micro Credit Scheme

More information on the required documents and process can be found on BSN's website.

4. BizMula-i and BizWanita-i schemes

Both BizMula-i and BizWanita-i are direct financing schemes under Credit Guarantee Malaysia Berhad (CGC) for businesses operating for less than 4 years in all economic sectors other than SMEs in the primary agriculture sector and Micro Enterprises.

Benefits of BizMula-i and BizWanita-i schemes

- Loan of up to RM300,000 per SME for a maximum period of 5 years.

- A grace period of 6 months, where no repayment is needed within this period.

Eligibility for BizMula-i and BizWanita-i schemes application

- Meet the definition of SMEs.

- Malaysian-owned business.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

- Business in operation for less than 4 years.

- Key person must be at least 21 years old at the point of application and maximum of 65 years old upon full settlement.

- Maximum shareholders’ funds not exceeding RM5 million.

- Shareholding by public listed companies and government-linked companies (if any) not exceed 20%.

Applicable period for BizMula-i and BizWanita-i schemes

Open.

How to apply for BizMula-i and BizWanita-i schemes

Download the application form from CGC’s website. All required documents are stated in the forms.

5. Government Guarantee Schemes by SJPP

RM5 billion worth of guarantees is provided through Syarikat Jaminan Pembiayaan Perniagaan (SJPP) to SMEs that face difficulties in getting loans. The guarantee coverage has increased from 70% to 80% as well.

Benefits Government Guarantee Schemes by SJPP

- Guarantee coverage of 80%.

- Applicable for several schemes.

- Guarantee fee of 0.5% per annum.

Eligibility for Government Guarantee Schemes by SJPP application

- Meet the definition of SMEs.

- A non-manufacturing company with sales turnover not exceeding RM20 million or the number of full-time employees not exceeding 75 workers. A manufacturing company with sales turnover not exceeding RM50 million or the number of full-time employees not exceeding 200 workers.

- Malaysian-owned business.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

- Not a public listed company or a subsidiary of a public listed company, multinational corporation, and government-linked companies.

- Some cases of eligibility are scheme-specific.

Applicable period for Government Guarantee Schemes by SJPP

Until 31st December 2020.

How to apply for Government Guarantee Schemes by SJPP

- SMEs apply financing facilities from PFIs.

- In case the SME lacks or does not have any collateral, PFIs will submit scheme applications to SJPP directly.

- SJPP will review the application for approval and inform the PFIs.

Setting up of new initiatives

6. Government Guarantee Scheme by Danajamin

RM50 billion worth of guarantees is provided through Danajamin Nasional Berhad to viable businesses in all sectors facing difficulties due to the COVID-19 pandemic with a guarantee coverage of up to 80%.

Benefits of Government Guarantee Scheme by Danajamin

- Guarantee coverage of 80%.

- The minimum guarantee loan of RM20 million per business

Eligibility for Government Guarantee Scheme by Danajamin application

Subject to credit evaluation by Danajamin Nasional Berhad.

Applicable period for Government Guarantee Scheme by Danajamin

1st May to 31st December 2020.

How to apply for Government Guarantee Scheme by Danajamin

To be announced.

7. Special Grant for micro SMEs

A total of RM2.1 billion has been allocated to benefit 700,000 micro SMEs in the country. The government will obtain the list of eligible micro SMEs from SSM and local authorities directly.

Benefits of Special Grant for micro SMEs

RM3,000 is allocated for each micro SME.

Eligibility for Special Grant for micro SMEs application

- Micro-enterprises affected by the COVID-19 pandemic.

- Meet the definition of micro-SME.

- Registered with the LHDN.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

Application period for Special Grant for micro SMEs

From 1 May 2020 to 15 May 2020

How to apply for Special Grant for micro SMEs

Applications are closed.

8. Micro Sector Business Recovery Financing Scheme (CBRM)

A total amount of RM200 million has been allocated for this scheme. Entrepreneurs can choose between the Micro Credit Scheme or the CBRM.

Benefits CBRM

- The loan ranges from RM1,000 to RM10,000 for a period of 3 years.

- No interest.

Eligibility for CBRM application

- Micro-enterprises affected by the COVID-19 pandemic.

- Malaysian-owned business.

- Has a specific business location.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

- Not blacklisted by any financial institution.

How to apply for CBRM

It can be done online through the CBRM portal.

Assistance to companies facing cash flow constraints

To reduce the burden of companies in terms of payments towards EPF, HRDF and taxes, several measures have been introduced.

9. Employer Advisory Services (EAS) programme

Introduced by the Employees Provident Fund (EPF) on 15 April 2020, the EAS programme aims to assist employers so that they can continue retaining jobs by offering options to defer, restructure and reschedule the remittance of the employer’s portion of monthly EPF contributions. The conditions of companies will be assessed and customised plans on EPF contributions will be offered. This programme is estimated at RM10 billion to benefit over 480,000 SMEs, besides securing more than 8 million jobs in Malaysia.

Details of EAS

To be announced.

10. Employer COVID-19 Assistance Programme (e-CAP)

In addition to the Employer Advisory Services, EPF has launched e-CAP on 23 April 2020 for SMEs to defer and restructure employer contributions.

Benefits of e-CAP

- Deferment and restructuring of employer’s share of EPF contribution payments for April, May, and June 2020.

- Deferred contributions to be settled over a maximum period of 3 months.

- Examples of payment due dates:

Eligibility for e-CAP application

- SME employers that have less than 200 employees on payroll.

- All monthly contribution payments up to the February 2020 contribution date are in order.

- Employee's EPF portion for the contribution months being applied for (e.g. April, May or June) has been paid up.

Applicable period for e-CAP

April, May, and June 2020.

How to apply for e-CAP

Applications can be made through the e-CAP function in i-Akaun (Majikan) on a monthly basis. Employers not eligible for e-CAP are encouraged to contact EPF for alternative solutions.

11. Human Resources Development (HRD) levy exemption

For Human Resources Development Fund (HRDF) registered employers, the payment of the mandatory Human Resources Development (HRD) levy has been exempted for 6 months to support over 30,000 of the HRDF registered employers from all sectors instead of the initially selected sectors as announced earlier.

Benefits of HRD levy exemption

HRD levy exemption for 6 months.

Eligibility for HRD levy exemption application

All registered employers from all sectors.

Applicable period of HRD levy exemption

1st April to 30th September 2020.

12. Postponement of income tax instalment payments

Regarding the monthly income tax instalment payment to the Inland Revenue Board (IRB), all SMEs are allowed to postpone payments for a period of 3 months, instead of the 6 months deferment for the tourism sector only as announced earlier.

Benefits of income tax instalment payments postponement

- Postponement of income tax instalment payments for 3 months.

- Revision of tax estimates in the 3rd month of the accounting period is allowed by submitting an application to the IRB.

Eligibility for income tax instalment payments postponement

All SMEs.

Applicable period for income tax instalment payments postponement

1st April to 30th June 2020 (until 30th September 2020 for the tourism sector).

13. Wage Subsidy Programme

As an extension of the Employment Retention Programme (ERP), the government will subsidise the salary of eligible employees with a total allocation of RM5.9 billion to the Employment Insurance System (EIS) that will benefit 3.3 million employees in the private sector. The allocation has been increased to Rm13.8 billion with amended conditions.

Benefits of wage subsidy programme

- The subsidy will be credited to the employer’s account within 7 to 14 days of application submission for each eligible employee for 3 months.

- For companies with more than 200 employees, the subsidy is RM600 per month per employee.

- For companies with 76 – 200 employees, the subsidy is RM800 per month per employee.

- For companies with 75 or fewer employees, the subsidy is RM1,200 per month per employee.

Eligibility for wage subsidy programme application

- Employers with 50% drop in revenue since 1st January 2020, except for SMEs with less than 75 employees as announced on 6th April 2020.

- Only for employees with wages below RM4,000 who are registered under the EIS.

- Employers must not terminate or force employees to take unpaid leave for a period of 6 months after the implementation of this programme.

- Employer must pay the full amount of wages to existing employees without pay cut after the implementation of this programme.

- Limited to only 200 employees per company, instead of 100 employees as announced earlier.

Period of wage subsidy programme

3 months.

How to apply for wage subsidy programme

Application can be made through the PERKESO portal.

Assistance to B40 entrepreneurs

For entrepreneurs and people who belong to the B40 category with a monthly income of RM3,900 and below, a social financing program is introduced by Bank Negara Malaysia in collaboration with Islamic banking institutions, state Islamic religious councils and key implementing partners.

14. iTEKAD programme

This is the first phase of collaboration between Bank Islam Malaysia and selected State Islamic Religious Councils including Majlis Agama Islam Wilayah Persekutuan and implementation partners such as SME Corporation Malaysia that has been introduced in May 2020.

Benefits of iTEKAD programme

- Loan of up to RM50,000 per entrepreneur with an interest rate of 4% for a maximum period of 5 years.

- Initial capital for micro-entrepreneurs using zakat funds.

- Microfinancing with affordable rates.

- Training in entrepreneurship and financial management.

- Support in business development.

Eligibility for iTEKAD programme application

- Micro-enterprises under B40 and Asnaf category based in Federal Territory of Kuala Lumpur, specializing in the food & beverage, manufacturing and service industries.

- Meet the definition of micro-enterprise.

- Malaysian-owned business.

- Registered with the Companies Commission of Malaysia (SSM) or Local Authorities.

- Business in operation for at least 1 year.

- For micro-entrepreneurs aged between 21 to 60 years old at the point of application.

Application period for iTEKAD programme

From 1 May 2020 to 30 June 2020.

How to apply for iTEKAD programme

More information can be found on the iTEKAD webpage. Required documents should be emailed to sadaqahouse@bankislam.com.my.

Besides the initiatives listed above, these are other initiatives announced:

- An extension of the moratorium to loans from TEKUN, Mara, cooperatives and other financing-providing government agencies besides those provided by banking institutions.

- A 6-month lease exemption for premises owned by the Federal Government and rental discount or exemption for other government-linked companies such as MARA, Petronas, PNB, Plus and UDA.

- All major projects under Budget 2020 will continue as planned including the ECRL, MRT2, as well as the National Fiberisation and Connectivity Plan (NFCP) to ensure sustainable economic development.

- Special allocations to ensure food security worth RM1billion to the Food Security Fund, RM100 million for preparation of related infrastructure facilities, and a special fund of between RM100,000 and RM200,000 for each viable Area Farmers and Fishermen’s Organizations.

- Tax deductions on donations to the COVID-19 fund as announced by the Minister of Finance, Tengku Datuk Seri Zafrul Aziz.

- Electricity bill discount for all sectors for a period of 6 months.

- Tax exemption for private entities that provide at least 30% rental discount for tenants.

- A 25% reduction in foreign employee's levy payments for work permits expiring between 1 April 2020 to 31 December 2020.

A survey done by Recommend.my showed that nearly 70% SMEs lost half of their income within the first week of the Movement Control Order imposed to curb the spread of the COVID-19 virus. Despite such pessimistic prospects, actively leveraging the initiatives offered by the Government and preparing for the post-pandemic opportunities would be advisable for all SMEs in Malaysia to pull through this crisis we are facing together now.

Table of Contents

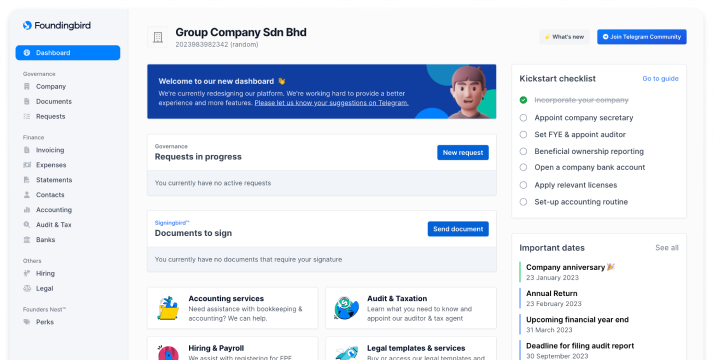

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll