The Complete Guide to the Malaysia Tech Entrepreneur Program (MTEP) - 2026

Complete guide to the Malaysia Tech Entrepreneur Programme (MTEP) visa for foreign entrepreneurs and tech founders. Learn about eligibility, requirements, application process, fees, benefits, and everything you need to know about building your startup in Malaysia.

Hi there! 👋

I'm Dylan, Founder & CEO at foundingbird.com and a fellow MTEP entrepreneur. Thank you for checking out this guide — I've put a lot of time into creating it!

When I first applied for the Malaysia Tech Entrepreneurship Program (MTEP), I was impressed by the program's thoughtful design and efficient application processes. However, I noticed that information and community support around the program were somewhat limited. Having been on the pass for a couple of years and experienced firsthand what it takes to start a company in Malaysia, I now assist other entrepreneurs in navigating this journey.

I hope with this guide I can answer some questions you may have and help you decide whether the program is right for you.

Best,

Dylan Damsma

1. An Introduction to MTEP

What is Malaysia Tech Entrepreneurship Program (MTEP)?

The Malaysia Tech Entrepreneurship Program is a visa program specially designed to attract tech / startup entrepreneurs, both new & experienced, to build their startup in Malaysia. The visa allows foreign entrepreneurs to reside and establish their business in Malaysia.

It was started as a program by MDEC, which is short for Malaysia Digital Economy Corporation, to attract tech entrepreneurs and strengthen the local startup ecosystem. MDEC's primary goal is to make Malaysia the preferred hub for digital businesses and talents.

Who is the Program For (and Not For)?

The visa program is designed for new and experienced startup / tech entrepreneurs who are developing proprietary software or technology aimed at improving or solving problems in various industries. These industries include, but are not limited to, AgriTech, HealthTech, Drone Technology, FinTech, Cybersecurity, Smart Cities, Mobility, AI and Robotics, Blockchain, and Big Data.

It's important to note that the key word here is "proprietary technology (software/hardware)". Consulting services, trading / retail, software integrations, etc do not qualify as activities for the program, even if they are in the aforementioned industries.

Examples of companies that would qualify for MTEP

| Company | Why It Qualifies (or Doesn't) |

|---|---|

| A startup building its own AI-powered crop disease detection app | Proprietary AgriTech software |

| A team developing a custom blockchain platform for supply chain tracking | Proprietary Blockchain technology |

| A company creating its own cybersecurity threat detection software | Proprietary Cybersecurity product |

| A startup building proprietary drone hardware for agricultural surveying | Proprietary Drone Technology |

| A HealthTech company developing its own telemedicine platform with AI diagnostics | Proprietary HealthTech software |

| Company | Why It Doesn't Qualify |

|---|---|

| An IT consulting firm advising banks on digital transformation | Consulting services (no proprietary tech) |

| A company reselling and integrating Salesforce or SAP solutions | Software integration, not proprietary |

| An e-commerce business selling electronics online | Trading/retail |

| A recruitment agency specializing in tech talent | Service business, no proprietary technology |

| A company that customizes and deploys open-source software for clients | Integration/customization, not proprietary development |

| A dropshipping business in the "smart home" space | Retail/trading, not developing technology |

Key Question to Ask Yourself: "Am I building something new and proprietary, or am I reselling, integrating, or consulting on existing technology?"

If you're not sure if your activity qualifies, you can schedule a consultation with me to go into your specific use-case.

2. The Two Types of Visas, Benefits & Criteria

Under this program, there are 2 different visa’s being awarded to tech entrepreneurs:

New Tech Entrepreneur

This option is for for tech founders with no track record of any prior startup, established business or successful exit. It’s generally expected that you do have a tech background. If you never worked in tech, at a startup, never developed a product, etc - you may have a harder time convincing the panel.

Type of pass: Professional Visit Pass (PVP)

Duration: Max. 1 year + renewable by 1 year

Application fee: Roughly MYR 2,700

Notes:

- Once you completed 2 years New Entrepreneur with achievement, you may apply for Established Entrepreneur

- Up to 2 co-founders max.

- No dependents allowed

- It’s required to get a contract with one of the approved Malaysia Digital Hubs (co-working spaces)

- Company (employer) listed on the visa will be: Malaysia Digital Economy Corporation (MDEC)

Experienced Tech Entrepreneur

For entrepreneurs who have at least 3 years track record of building / running their own established business and can show at least 2 years of financials of that company. For example entrepreneurs who have previously had a successful exit or been running the company for the past 3 years and are looking to expand / move to Malaysia.

Type of pass: Residence Pass (RP)

Duration: 5 years - renewable

Application fee: Roughly MYR 5,400

Notes:

- Allows for dependents (Spouse & Children - allowed to work)!

- In some circumstances allows for bringing parents, parents-in-law, partner under common law marriage, etc. See the official FAQ. - Not allowed to work.

- This pass makes it easier to open personal bank accounts, get loans, etc. as you’re considered ‘full resident’ in Malaysia.

It’s not required to have a degree for either program; however, if you do not have any qualifications from an institution of higher education (i.e. diploma, bachelor’s, master’s, or PhD), you will need to justify your capability by demonstrating how you have acquired the knowledge to start the proposed company.

3. How Does It Compare Against Digital Nomad Visa & MD Status

MDEC has two other programs that seem somewhat similar but serve different target audiences. I often get asked what’s the difference between MTEP and the other two programs and what is the “better option”. The answer, as usually is with these things, depends. That said, I have tried to outline the differences below and a few simple questions that can help you determine which is the best option.

Digital Nomad Visa (DE Rantau)

This visa is designed for remote workers, freelancers, and independent contractors. To qualify, you should already have an existing job or contract with a minimum annual income of USD 24,000 for tech professions or USD 60,000 for non-tech professions.

If you plan to stay in Malaysia for up to 24 months while working for overseas clients or your foreign employer, this program is ideal for you. However, it's important to remember that working for a Malaysian company is not permitted under this program.

So if your intention is to start your own business in Malaysia, then this may not be the right program to apply to.

Malaysia Digital (MD) Status

The Malaysia Digital program is a little bit different than both the MTE & Digital Nomad programs. As in itself it is not a visa program, but rather a status that a company incorporated in Malaysia can acquire.

The goal of the program is to encourage and attract companies and talents in the digital / tech sectors in Malaysia and provide incentives & certain privileges to such companies to achieve this.

The companies business nature needs to be aligned with the promoted activities under Malaysia Digital, thereby there are certain conditions like operating expenditure & hiring requirements.

Under this program, it is possible to get a pre-approved allocation for so called “Foreign Knowledge Workers” which is an individual who holds one or more of the following criteria:

- Holds a tertiary qualification from an institution of higher learning (in any field); or

- Holds a diploma in multimedia/ICT or another specialised ICT certification plus at least 2 years’ relevant experience in multimedia/ICT or an equivalent field; or

- Has held a professional, executive, management or technical work position in information technology (“IT”) enabled services (e.g. IT / IS Professionals, Finance / Accounting, Business Administration)

If these criteria are met and you have been able to acquire MD status, it would be possible to apply for employment pass for either yourself or employee(s) you intent to hire. However, having been granted MD status does not automatically grant you the visa itself. You will still need to apply and go through the employment pass application process.

So when does it make sense to go the route of MD status instead of MTEP? Well, that does depend a little bit on your situation. However, I’d say the main factor in answering that question would be what type of business you’re starting.

It is totally possible for a company started by an MTE pass holder to apply for MD status. Therefore, also it would be possible to switch your MTE pass to an employment pass under the MD Foreign Knowledge Worker program. (This may be preferred over a New Entrepreneur pass if you want to bring dependents. But for experienced entrepreneurs we strongly recommend the MTE pass)

That said, to establish a company it is required to have at least 1 director who ordinarily resides in Malaysia. Therefore, if you are a solo founder and/or all founders are foreigners, it becomes paramount to first get a visa before you can incorporate your company. — You can see the chicken & egg problem 🥚🐓 that you might run into if you wanted to take the MD route.

If you’re starting a company with it’s own proprietary software/hardware in any of the target MTEP sectors, we recommend applying for the MTE pass first. However, if you do not have any proprietary tech, yet your primary business nature is in one of the following sectors:

- Digital Agriculture

- Digital Services

- Digital Cities

- Digital Health

- Digital Finance

- Digital Trade

- Digital Content

- Digital Tourism

- Islamic Digital Economy

Then you may want to consider incorporating a company using a local partner and/or nominee director (a service we can provide) and then applying for MD status.

4. Nationalities with Potentially More Risk

Before we dive into the application process and all the exciting stuff that comes after it, it’s important that we address a potential issue for entrepreneurs from any of the listed high-risk jurisdictions below:

*Countries on the UNSC/FATF lists or flagged countries such as India, Indonesia, Iran, Iraq, Afghanistan, Sri Lanka, Syria, Myanmar, Nicaragua, Pakistan, Panama, Senegal, Uganda, Yemen, Zimbabwe, Albania, Algeria, North Korea (DPRK), Burkina Faso, Cambodia, Cayman Islands, Ghana, Mexico, Colombia, Botswana, Barbados, Jamaica, Mauritius, Kazakhstan, Russia and Israel.

Note: If your country is not listed above, but you’re from a country where there’s an ongoing conflict, political tensions or you’re not sure if you’re from a high risk jurisdiction - do consult us.*

While applying for the visa and incorporating a company as a national of one of these countries may not be an issue (exception for Israeli’s whom require special approval), banking and access to financial institutions can be extremely challenging.

That does not mean it is completely impossible, as we have assisted clients from these jurisdictions to access bank accounts before, however prior consultation is extremely important.

Of course, it would be a shame to apply for a visa, move to Malaysia, incorporate a company and then find out that opening a bank account for your company is not possible. Extremely frustrating in fact.

Therefore, If you are from one of these countries, I recommend scheduling a consultation call to discuss your options. Whether they work for you or not is entirely dependent on your personal situation and we can’t really give any advise without going into the details.

5. Application Process

Alright, let's get into the nitty-gritty of how to actually apply for MTEP. I'll walk you through the documents you need, the application steps, costs, and what to expect timeline-wise.

What Documents to Get

Before you can submit your application, you'll need to gather a few key documents. Some of these take time to arrange, so I'd recommend starting on these as early as possible.

Malaysia Digital Hub

One of the requirements for the New Tech Entrepreneur track is to secure an agreement with a Malaysia Digital Hub. These are essentially approved co-working spaces that partner with MDEC to support the MTEP program.

You'll need to sign a contract with one of these hubs before you can submit your application. The contract typically needs to be for at least 12 months to align with your visa duration.

Here are some of the approved Malaysia Digital Hubs:

| Hub Name | Location | Notes |

|---|---|---|

| Common Ground | Multiple locations (KL, PJ) | Popular choice, good networking |

| WORQ | KL, PJ | Strong startup community |

| Co-labs | KL | Good facilities |

| Colony | KL | Premium option |

The hub will provide you with a signed agreement letter that you'll need to include in your application. Some hubs are more familiar with the MTEP process than others, so don't hesitate to ask them about their experience with MTEP applicants.

Note: If you're applying as an Experienced Tech Entrepreneur, the Digital Hub requirement is not mandatory, though you're still welcome to use one.

Personal Bond

This one catches some people off guard. You'll need to provide a Personal Bond as part of your application — essentially a guarantee that you'll comply with the terms of your visa.

The bond amount is typically MYR 1,500 - MYR 2,000 and needs to be issued by a Malaysian individual. Since you're likely not in Malaysia yet, this can be a bit tricky to arrange on your own.

We can help facilitate this for you as part of our application package, or you can arrange it through the Malaysia Digital Hub you've partnered with — some of them offer this as an add-on service.

Other Required Documents

Here's a checklist of everything else you'll need:

For Both Tracks:

- Passport (valid for at least 18 months)

- Passport-sized photos (white background)

- Updated CV/Resume

- Pitch deck (more on this below!)

- Personal statement / cover letter explaining your business idea

- Proof of funds (Min balance of RM50,000 - or equivalent in other currencies - over the past 3 months)

Additional for Experienced Entrepreneur:

- Company registration documents of your existing/previous business

- 2 years of audited financial statements

- Evidence of your role (board resolutions, shareholding certificates, etc.)

- Any press coverage, awards, or recognition (if available)

How to Apply

The application process is done through MDEC's online portal. Here's the step-by-step:

- Create an account on the MTEP portal at mtep.my

- Fill out the online application form — this includes personal details, business information, and uploading all your documents

- Pay the application fee (see fee structure below)

- Submit and wait — your application will be reviewed by MDEC

- Pitch / Business presentation — if your application passes initial screening, you may be invited for a call or in-person meeting to defend your pitch & business idea.

- Approval & visa issuance — if successful, you'll receive your approval letter and can proceed to get your visa endorsed

Fee Structure

Let's talk money. Here's what you can expect to pay:

New Tech Entrepreneur (PVP)

| Item | Cost (approx.) |

|---|---|

| Application & processing fee | MYR 1,500 - 2,000 |

| Personal Bond (refundable) | MYR 2,000 |

| Visa endorsement fee | MYR 500 - 700 |

| Total | ~MYR 4,000 - 4,700 |

Experienced Tech Entrepreneur (RP)

| Item | Cost (approx.) |

|---|---|

| Application & processing fee | MYR 3,500 - 4,000 |

| Personal Bond | MYR 2,000 |

| Visa endorsement fee | MYR 500 - 700 |

| Total | ~MYR 6,000 - 6,700 |

Note: These are approximate figures and may vary. MDEC occasionally updates their fee structure, so always confirm the latest fees on the official portal.

The Pitch Deck

Your pitch deck is arguably the most important part of your application. This is where you convince the panel that your business is legitimate, innovative, and has potential.

Here's what your deck should cover:

- Problem — What problem are you solving?

- Solution — How does your technology solve it?

- Product — Demo, screenshots, or prototype of your tech

- Market Opportunity — How big is the market? Why now?

- Business Model — How will you make money?

- Traction — Any users, revenue, partnerships, or milestones?

- Team — Who are you and why are you the right person to build this?

- Why Malaysia — This is important! Show you've done your homework

- Roadmap — What are your plans for the next 12-24 months?

- Ask — What do you need to succeed?

- Decks that are too vague about the actual technology

- No clear explanation of why Malaysia specifically

- Overcomplicating things — keep it clear and concise

Remember, the panel wants to understand your business in 10-15 minutes. If they're confused, that's not a good sign.

Not sure how to approach the pitch deck or application process? Schedule a consultation with me to go into more detail.

Timelines

So how long does this all take? Here's a realistic timeline:

| Stage | Duration |

|---|---|

| Document preparation | 1-2 weeks |

| Application submission & panel review | 2-4 weeks |

| Pitch / Call invitation | 1-2 weeks after initial screening |

| Final Decision | 1-2 weeks after pitch |

| Visa issuance | 1-2 weeks after approval |

| Total (if all goes smoothly) | 6-10 weeks |

That said, I always tell people to expect some variability. Sometimes MDEC is faster, sometimes there are backlogs. Public holidays in Malaysia can also slow things down.

If you're in a rush or want to make sure everything goes as smoothly as possible, working with an experienced partner (like us!) can help avoid delays from document issues or application errors. Get in touch to discuss your application.

6. Incorporation of a Sdn Bhd (Private Limited Company)

Incorporating a Sdn Bhd in Malaysia can be done anytime that you meet the basic criteria, the most important one being that at least one (1) director ordinarily resides in Malaysia.

Therefore, if you’re a solo foreign founder or all directors are foreigners currently not on a valid permit to reside in Malaysia (Social Visit / Tourist Pass does not qualify), it is important to go through the MTEP application first, which we do recommend regardless.

Once you've acquired 'ordinary residence' status in Malaysia (by means of a valid visa & tenancy agreement, see above) it is possible to incorporate your company in Malaysia as a 100% foreign-owned Sdn Bhd (private limited company).

It’s important to note, that unlike some misconceptions, it is not required to have a Malaysian citizen as a partner (shareholder and/or director) in the business, as long as you fulfill the criteria of having at least 1 director with ordinary residence in Malaysia, which a foreigner can be with a valid visa.

The incorporation process itself is easy and is something we can assist with, in broad lines:

- Get your visa, documents proving residency (i.e. tenancy agreement), and passports ready.

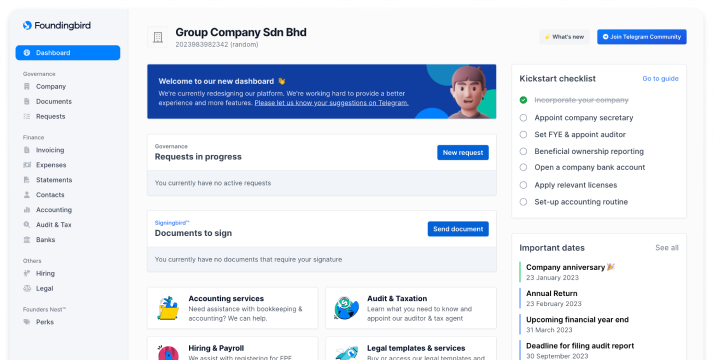

- Go to app.foundingbird.com to create an account.

- Fill out the required details of your company, such as:

a. Name & explanation of name

b. Business description & nature of business

c. Business location (we can provide office address if needed)

d. Who will be the directors?

e. Who will be the shareholders and how will shares be distributed? - Make payment for the incorporation of your Malaysian Sdn Bhd.

- Complete the online KYC (identity verification) process.

- Sign the final documents to confirm the company details for incorporation.

The entire process takes roughly 3 to 4 business days, depending on how quickly you fulfill each step. Once the company has been approved by the Malaysian Companies Commission (SSM), you will receive all of the documentation such as your incorporation certificate via our application.

After the incorporation is done, we will go through a so-called post-incorporation process, which involves:

- Appointing a licensed company secretary (required by law within 30 days of incorporation)

- Opening a corporate bank account for your business

- Fixing your financial year end, appointing an auditor & tax agent

- Setting up your accounting routine (add-on)

- Statutory registration - prepare you for hiring

- Review & apply for any licenses required (usually not needed for tech startups - except for a premise license if you have your own office)

After that, you're entirely ready for business!

7. Corporate Compliance & Taxes

Starting a company comes with certain responsibilities. Unfortunately, we see it all too often… Dreams are big at the start and a company is incorporated, however when things don’t work out, the company gets neglected under the excuse “it’s not active”. Let me be clear: Don’t do that.

It’s extremely important to stay on top of your annual compliance and it can be simple once you have a few simple routines in place. Not doing so can result in hefty penalties and can impede on your ability to do any business in Malaysia in the future. Thereby, if you use Foundingbird, we will of course remind you and help you with these matters.

In Malaysia, every Sdn Bhd is required to take care of the following:

1. Retaining a licensed company secretary & registered office

It’s required by law to appoint & retain a licensed company secretary. This is a licensed professional who acts as compliance officer and administrative point person of the company. Think of them as a “legal guardian” who ensures the business follows all government rules and regulations.

- Handles all paperwork with the government (SSM)

- Keeps track of important company documents

- Reminds directors of deadlines and compliance requirements

- Takes notes during important meetings such as AGM or board meetings.

- Makes sure the company follows the law

- Maintains companies statutory records (like who owns shares, who the directors are)

- Helps with changes in the company structure (adding/removing directors, changing shareholders)

It’s also useful to note that it’s impossible to open a bank account or file your annual return (see below) without having one appointed, so definitely make sure you get this sorted. This is a service that we provide.

In addition to that, you will need to have a registered office (this is normally the office of the company secretary - for simplicity sake), this is where all the official records are kept and open for inspection to the authorities.

2. Annual Return

When: On the anniversary of the company (every year)

Government Fee: RM150

Penalty for non-compliance: up to RM50,000 per director (usually ~RM5000)

Every year the company needs to file a so-called "annual report". An annual report must be filed with the Companies Commission of Malaysia (SSM) within 30 days of the company's incorporation anniversary date, containing key company information, financial statements, and details of directors and shareholders.

3. Business Licenses

Depending on your business activity you may need specific licenses. Some of the common licenses however include local council licenses (i.e. premise license, signboard license).

We recommend discussing your license requirements with your account manager at Foundingbird as it’s very dependent on your specific company and location.

Most tech startups wouldn’t need a license to operate their business, except from the premise license if they have their own office, that said it is still best to double check as some industries like tourism or healthcare could have some exceptions.

4. (Un)Audited Financial Report / Statements

When: Within 6 months after financial year end

Government Fee: RM50

Penalty for non-compliance: up to RM50,000

Every new Sdn Bhd should fix their Financial Year End within 6 to 18 months from the date of incorporation, and subsequently it would be yearly on that date. This is the period for which you have to prepare your financial management accounts and get an audit done.

Note: Companies may qualify for audit exemption if they meet certain criteria (updated 2026):

- Private company (Sdn Bhd)

- Revenue less than RM2mil

- Assets less than RM2mil

- Less than 20 employees

However, if your company has serious business activity, we generally recommend doing the audit as the fees for unaudited reports aren’t that much lower and it is still required to retain / appoint an auditor regardless. Filing the audited report can be beneficial if you plan to get certain financial aid such as loans in the future.

Within 6 months of your financial year end, you will then have to file these reports with SSM.

5. Tax Filing & SST

Every Sdn Bhd needs to handle several tax-related matters:

Corporate Income Tax

- First tax return (Form E): Within 7 months from financial year end

- Must be filed even if there's no income!

- Current corporate tax rate: 24% (Lower rates may apply for companies with malaysian shareholders)

Estimated Corporate Income Tax (ECI)

- Submit estimate 30 days before the start of financial year

- Pay in monthly installments

- Can be revised up to 6th month of the financial year

- New companies exempted for first 2 financial years

- Penalty for underestimation: Up to 10% of the difference

Sales & Service Tax (SST)

- Sales Tax: 5-10% on manufactured/imported taxable goods

- Service Tax: 6% on taxable services

- Registration required if:

- Sales Tax: Manufacturing revenue exceeds RM500,000

- Service Tax: Revenue from taxable services exceeds RM500,000

- Must be filed bi-monthly

- Late filing penalties can be severe

Employment Related Taxes (Only if you have employees)

- Monthly Tax Deductions (PCB/MTD) for employees

- EPF contributions (employer portion: 12-13%)

- SOCSO contributions

- EIS contributions

- HRDF levy (if applicable, 1% of monthly payroll)

- Annual Return of Employee Remuneration (Form E)

As a founder myself, I know how not fun this stuff sounds and understand you rather work on your product! That said, it’s pretty important to get sorted and honestly is pretty simple once you got the routines embedded in your companies operations.

Of course we offer tax, HR and accounting services to assist you with all of these. It's one of those things where having professional help usually saves you both headaches and money in the long run.

8. Banking & FinTech for MTEP entrepreneurs

One of the most contentious topic we usually deal with is banking. First of all, of course it’s of paramount that you get access to the financial ecosystem if you want to do business, but unfortunately it’s not always a guarantee simply because you have a visa and a company incorporated.

At Foundingbird, we work with our clients and our banking partners everyday to solve this challenge, finding a balance between getting the ideal client for the bank and getting the corporate accounts opened for our clients.

For Founders under MTEP, there are usually 2 accounts that require opening, both business and personal. What we generally recommend is to focus on the business banking first and then use the approval of that account to apply for a personal account at the same bank.

Since MTEP is relatively new and banks tend to move slowly in changing their internal processes, not all banks recognize the pass itself yet. The main challenge is that the company listed in your visa is “Malaysia Digital Economic Corporation” and not the company you incorporate and try to open an account for. Therefore we constantly work with both MDEC and banks to find solutions for you as business owner.

MDEC will be able to issue a letter in support of your bank account opening request and Foundingbird constantly works on improving the relationships we have with banks and their understanding of the program.

Here are the banks that we currently recommend:

However, do understand that each bank has their own compliance process and policies are forever changing, so everyone’s experience may be a bit different here. That said, we will relentlessly aim to help you open an account, no matter how long it takes.

In addition to banks, there are also some FinTech solutions we recommend clients to take a look at:

- Swipey (VISA card)

- MoneyMatch (FX)

9. Renewal Process

So you've been in Malaysia for a while, building your startup, and your visa is approaching expiry. What now? Let me walk you through what the renewal process looks like for both tracks.

When to Start

This is probably the most common question I get — and the most important. Don't leave it until the last minute.

| Pass Type | When to Start Renewal |

|---|---|

| New Entrepreneur (PVP) | 2-3 months before expiry |

| Experienced Entrepreneur (RP) | 3-4 months before expiry |

MDEC and immigration processes can be unpredictable, and you really don't want to be in a situation where your visa expires while your renewal is still pending. While there are provisions for this, it creates unnecessary stress and can complicate things like banking and travel.

New Entrepreneur (PVP) Renewal

As a New Entrepreneur, your PVP is valid for 1 year and can be renewed for another year.

What you'll need:

- Current passport (valid for at least 12 months beyond your intended stay)

- Updated pitch deck showing your progress

- Progress report on your business activities

- Proof of continued Malaysia Digital Hub membership

- Updated personal bond

- Personal Bank statements showing financial sustainability

- Any evidence of traction (users, revenue, partnerships, local hires)

What MDEC is looking for:

The panel wants to see that you've actually been working on your business and making progress. You don't need to be profitable or have raised millions, but you should be able to demonstrate:

- You've been actively developing your product/technology

- You're genuinely building your company in Malaysia (not just using it as a visa for other purposes)

- You have a clear plan for the next 12 months

After 2 Years on New Entrepreneur

Once you've completed 2 years as a New Entrepreneur with demonstrated achievement, you may become eligible to apply for the Experienced Entrepreneur track. This is a significant upgrade — you'd move from a 1-year PVP to a 5-year Residence Pass, with the ability to bring dependents.

The transition isn't automatic though. You'll need to go through a fresh application process and demonstrate that your business has matured sufficiently.

Experienced Entrepreneur (RP) Renewal

If you're on the Experienced Entrepreneur track, your Residence Pass is valid for 5 years. The renewal process is less frequent but requires showing continued business activity and contribution to the Malaysian economy.

What you'll need:

- Current passport (valid for at least 12 months beyond intended stay)

- Company financial statements (audited)

- Tax compliance records (company and personal)

- Evidence of ongoing business operations

- Updated business plan / roadmap

- Proof of local economic contribution (hiring, revenue, partnerships)

What MDEC is looking for:

At this level, expectations are higher. They want to see:

- Your company is operational and generating activity

- You're contributing to the local economy (ideally through hiring Malaysians)

- Tax compliance is in order

- Your business is sustainable

Can Your Renewal Be Rejected?

Yes, it's possible. While I haven't seen it happen often, renewals can be rejected if:

- You haven't made meaningful progress on your business

- There are compliance issues (tax, immigration)

- Your business activities no longer align with MTEP criteria

- You've been largely absent from Malaysia

10. Living in Malaysia

Alright, let's talk about the fun stuff — actually living here! Malaysia is genuinely one of the best places in Southeast Asia for quality of life, especially as an entrepreneur. The cost of living is reasonable, the food is incredible, and the infrastructure is solid. Here's what you need to know.

Cost of Living Overview

One of the biggest draws of Malaysia is that your money goes a lot further here compared to Singapore, Hong Kong, or Western countries. Here's a rough breakdown of monthly costs:

| Expense | Budget (MYR) | Normal-Range (MYR) |

|---|---|---|

| Rent (2BR apartment) | 1,500 - 2,500 | 2,500 - 4,500 |

| Utilities (electricity, water, internet) | 200 - 300 | 300 - 500 |

| Food | 800 - 1,200 | 1,200 - 2,500 |

| Transportation | 300 - 500 | 500 - 1,000 |

| Mobile phone | 50 - 100 | 100 - 150 |

| Total | ~MYR 3,000 - 4,500 | ~MYR 5,000 - 9,000 |

Note: These are estimates for Kuala Lumpur. Costs can be lower in other cities like Penang or Johor Bahru.

Renting an Apartment

Finding a place to stay is one of the first things you'll need to sort out — because you'll need a tenancy agreement as proof of residence for various applications.

What to expect for a 2-bedroom apartment:

| Area | Price Range (MYR/month) | Vibe |

|---|---|---|

| KLCC / City Centre | 3,500 - 7,000+ | Premium, walkable, touristy |

| Bangsar | 2,500 - 5,000 | Expat-friendly, cafes, nightlife |

| Mont Kiara | 2,500 - 5,500 | Family-friendly, international schools nearby |

| Damansara Heights | 3,000 - 6,000 | Upscale, quieter, good for families |

| Petaling Jaya (PJ) | 1,500 - 3,500 | More local, affordable, good food |

| Bukit Jalil | 1,500 - 3,000 | Newer developments, more suburban |

Where to find apartments:

- PropertyGuru — Most popular platform

- iProperty — Another major listing site

- Facebook Groups — Search for "KL rentals" or "expats in KL housing"

- Agents — Foundingbird can provide a property agent to help you find suitable housing FOC

Tips for renting:

- Deposits are typically 2 + 0.5 — 2 months security deposit + 0.5 month utility deposit

- Furnished is common — Most condos come fully or partially furnished, which is great for newcomers

- Check the building facilities — Gym, pool, parking are standard in most condos

- Negotiate — Especially if you're signing a longer lease or the unit has been vacant

- Get everything in writing — Make sure your tenancy agreement is properly documented

- Get everything in writing — Make sure your tenancy agreement is properly documented

Key Areas for Expats & Entrepreneurs

Here's a quick guide to the main areas you'll likely consider:

Kuala Lumpur (KL)

The capital and main hub for startups. Most co-working spaces, investors, and tech events are here. If you're serious about building your network, KL is where you want to be.

- KLCC / Bukit Bintang — The iconic twin towers area. Great for meetings and impressive addresses, but can feel more corporate and very touristy. Traffic can be a bit of a menace.

- Bangsar / Bangsar South — My personal favorite for new entrepreneurs. Great cafes, restaurants, and a solid expat community. Also very central to all other areas of KL, like PJ, Bukit Jalil & KLCC.

- Mont Kiara — Very international, lots of families, plenty of amenities. Can feel a bit isolated from "real" KL.

- Bukit Jalil — A fast-developing area with newer condos and good value for money. Popular with expats looking for modern facilities, and quieter than central KL, but with easy access via public transport. More suburban vibe but lots of new cafes, malls (Pavilion Bukit Jalil), and recreational parks.

- Arkadia / Desa ParkCity — Known for its green spaces and walkability, Desa ParkCity (especially the Arkadia development) is super pet-friendly and community-oriented, with parks, running tracks, and a vibrant cafe scene. Popular with expats, young families, and anyone who wants a break from city traffic while staying within easy reach of KL's urban core.

Petaling Jaya (PJ)

Technically a different city, but it's right next to KL and many people live here. More affordable, great food scene, and some excellent co-working options like WORQ.

Penang

If you don't need to be in KL full-time, Penang is worth considering. Lower cost of living, amazing food (seriously, the best in Malaysia), and a growing startup scene. George Town has a unique vibe that attracts creative types.

Cyberjaya

Originally designed as Malaysia's tech hub / Silicon Valley equivalent. It's quieter and more suburban, with cheaper rents. Some government tech initiatives are based here, but honestly, most of the startup action is in KL these days. I'd personally avoid living here.

🚗 Owning a car:

Possible, but not necessary if you're in KL. Traffic can be brutal during rush hour. That said, having a car opens up weekend trips and makes life easier if you're in the suburbs. Second-hand cars are affordable here. What I personally suggest is using Grab for the first month(s) and seeing the overall costs.

11. Hiring in Malaysia

At some point, you'll probably want to grow your team. Whether it's your first hire or you're scaling up, here's what you need to know about hiring in Malaysia.

The Talent Landscape

Malaysia has a solid talent pool, especially for tech. The country produces a good number of engineering and IT graduates each year, and English proficiency is generally high — particularly in KL and Penang.

That said, competition for top talent is real. You're competing with local startups, regional companies, and increasingly, remote opportunities from overseas companies paying in USD/SGD.

Where to find talent:

| Platform | Best For |

|---|---|

| Professional roles, experienced hires | |

| JobStreet | General hiring, good volume |

| WOBB | Startups and younger talent |

| Hiredly | Tech and startup roles |

| GitHub / Stack Overflow | Developer hiring |

| Facebook Groups | Community-based hiring, referrals |

Salary Expectations

Here's a rough guide to monthly salaries for common startup roles in KL:

| Role | Junior (MYR) | Mid-Level (MYR) | Senior (MYR) |

|---|---|---|---|

| Software Developer | 3,500 - 5,000 | 5,000 - 9,000 | 9,000 - 15,000+ |

| UI/UX Designer | 3,000 - 4,500 | 4,500 - 7,500 | 7,500 - 12,000 |

| Product Manager | 4,000 - 6,000 | 6,000 - 10,000 | 10,000 - 16,000+ |

| Marketing | 3,000 - 4,500 | 4,500 - 8,000 | 8,000 - 14,000 |

| Operations / Admin | 2,500 - 3,500 | 3,500 - 5,500 | 5,500 - 9,000 |

| Finance / Accounting | 3,000 - 4,500 | 4,500 - 8,000 | 8,000 - 14,000 |

These are estimates and can vary based on industry, company stage, and specific skills.

For top-tier talent (think: engineers with FAANG experience, senior leaders), expect to pay significantly more — and be prepared to compete on equity and other benefits, not just salary.

Employment Basics

When you hire someone in Malaysia, here's what you're legally required to provide:

Statutory Contributions (Employer's Portion):

| Contribution | Rate | Notes |

|---|---|---|

| EPF (Employees Provident Fund) | 12-13% | Retirement savings |

| SOCSO (Social Security) | ~1.75% | Work injury & disability |

| EIS (Employment Insurance) | 0.2% | Unemployment insurance |

So on top of the gross salary, budget an additional ~15-20% for statutory contributions and employment costs.

Minimum Entitlements:

- Annual Leave: Minimum 8 days (increases with tenure)

- Sick Leave: Minimum 14 days

- Public Holidays: 11 gazetted holidays

- Maternity Leave: 98 days (as of recent amendments)

- Paternity Leave: 7 days

Hiring Foreigners

As an MTEP holder, you might want to bring in talent from overseas. This is possible, but comes with additional requirements:

Options for hiring foreign employees:

- Malaysia Digital (MD) Status — If your company has MD status, you get a pre-approved quota for Foreign Knowledge Workers

- Employment Pass — Standard work visa, requires minimum salary of MYR 5,000/month and various approvals

- Professional Visit Pass — For short-term assignments

The process can be bureaucratic, and there are requirements around hiring local talent before bringing in foreigners. Generally, for early-stage startups, it's easier to hire locally and only pursue foreign hires when you have specific skills you can't find in Malaysia.

Contractors vs Employees

Many startups start with contractors before moving to full employees. This can be a good way to stay lean, but be careful:

- Contractors — More flexible, no statutory contributions, but less control and loyalty

- Employees — More commitment, statutory obligations, but you're building a real team

Malaysian law looks at the substance of the relationship, not just what you call it. If someone works like an employee (fixed hours, your equipment, ongoing relationship), they may be considered an employee regardless of the contract.

Building Your Team

A few thoughts from my experience building teams here:

- Culture matters — Malaysians value harmony and relationships. Take time to build rapport with your team.

- Be clear on expectations — Direct communication styles can take some adjustment. Be explicit about what you need.

- Invest in growth — Offering learning opportunities and career development helps with retention.

- Equity can be compelling — ESOPs aren't as common here yet, which means offering equity can help you stand out to ambitious talent.

Need Help with HR & Payroll?

Managing HR, payroll, statutory contributions, and compliance can get complicated quickly — especially when you're trying to focus on building your product.

At Foundingbird, we offer HR and payroll services specifically designed for startups and small teams. We handle everything from employment contracts to monthly payroll processing to statutory filings, so you can focus on what matters most.

Learn more about our HR services →

12. Paying Yourself

One of the most common questions I get from founders is: "How do I actually pay myself?" It sounds simple, but there's more to it than just transferring money from your company account to your personal account. Let me break it down.

The Basics: Salary vs Dividends

As a founder-director of your Malaysian Sdn Bhd, you have two main ways to pay yourself:

1. Director's Salary

This is a regular salary paid to you as an employee/director of the company.

- Subject to income tax (progressive rates up to 30%)

- Requires monthly tax deductions (PCB/MTD)

- Counts as a deductible expense for the company

- Builds your EPF if you choose to contribute (optional for directors)

2. Dividends

Profit distributions to shareholders.

- Only possible if the company has profits

- Tax-free for recipients in Malaysia (single-tier system)

- Not a deductible expense for the company (paid from after-tax profits)

- No EPF or SOCSO implications

Setting Your Salary

There's no legal minimum for director salaries, but a few practical considerations:

Things to think about:

- Personal expenses — What do you need to cover your living costs?

- Tax efficiency — Malaysia's tax brackets mean there's often a "sweet spot"

- Banking requirements — Banks may want to see regular income for personal accounts/loans

- Immigration optics — While MTEP doesn't have a minimum salary requirement, showing you're sustaining yourself is important for renewals

- Company cash flow — Don't drain your runway paying yourself too much too early

Typical ranges I see:

| Stage | Monthly Salary (MYR) |

|---|---|

| Pre-revenue / bootstrapping | 3,000 - 6,000 |

| Early revenue | 5,000 - 10,000 |

| Established / funded | 10,000 - 25,000+ |

There's no right answer here — it depends entirely on your situation. Some founders pay themselves minimally and reinvest everything; others need a reasonable salary from day one.

The Process: How to Actually Do It

Here's what paying yourself looks like in practice:

For Salary:

- Set your salary — Document this in a board resolution or director's agreement

- Calculate deductions — Income tax (PCB), EPF (if applicable), SOCSO/EIS (if applicable)

- Process payroll — Calculate net pay after deductions

- Make payments — Transfer net salary to yourself, remit deductions to the relevant authorities

- Keep records — Payslips, payment records, submission receipts

- File annually — Report your income on your personal tax return (Form BE)

For Dividends:

- Check retained earnings — You can only declare dividends if you have distributable profits

- Board resolution — Document the dividend declaration

- Make payment — Transfer from company to shareholders

- Keep records — Dividend vouchers, resolutions, payment records

Tax Considerations

A quick overview of how your income is taxed:

Personal Income Tax Rates (Resident):

| Chargeable Income (MYR) | Tax Rate |

|---|---|

| 0 - 5,000 | 0% |

| 5,001 - 20,000 | 1% |

| 20,001 - 35,000 | 3% |

| 35,001 - 50,000 | 6% |

| 50,001 - 70,000 | 11% |

| 70,001 - 100,000 | 19% |

| 100,001 - 400,000 | 25% |

| 400,001 - 600,000 | 26% |

| 600,001 - 2,000,000 | 28% |

| Above 2,000,000 | 30% |

Note: Tax rates may change. Always verify with current LHDN (tax authority) guidelines.

You're considered a tax resident if you're in Malaysia for 182+ days in a calendar year. As an MTEP holder, you'll typically meet this requirement.

Deductions and reliefs — Malaysia offers various tax reliefs (lifestyle, medical, education, etc.) that can reduce your taxable income. Keep receipts!

Common Mistakes to Avoid

Over the years, I've seen founders make some avoidable errors:

-

Not paying themselves at all — Running everything through the company and using it like a personal account. This gets messy fast.

-

Paying themselves too much — Draining cash that the company needs. Remember, you can always increase your salary later.

-

No documentation — Just transferring money without board resolutions or proper payroll records.

-

Forgetting tax obligations — Not making PCB deductions or missing tax filing deadlines.

-

Mixing personal and business — Using the company account for personal expenses. Keep them separate!

-

Not planning for tax — Getting hit with a surprise tax bill because you didn't set aside money or make estimated payments.

13. Communities to Join

Building a startup can be lonely. Trust me, I know. Having a community of people who understand what you're going through makes a real difference — for your mental health, your network, and your business opportunities.

Here are the communities I recommend joining as an MTEP entrepreneur in Malaysia.

MTEP-Specific Communities

MTEP WhatsApp Group (Official)

There's an official WhatsApp group for MTEP pass holders where you can connect with other entrepreneurs on the program, ask questions, and share experiences.

To join, you'll need to request access from the MDEC team. You can ask your MDEC contact during your application process, or email them after you've been approved. It's worth joining — there's good knowledge sharing happening there, and it's helpful to connect with people who've been through the same process.

Startup & Entrepreneur Communities

Facebook Groups

Facebook is still very much alive in Malaysia, and there are several active groups worth joining:

| Group | Focus | Notes |

|---|---|---|

| Malaysian Startup & Entrepreneurship | General startup community | Large, active, good for questions |

| KL Startup & Tech Community | KL-focused | Events, jobs, discussions |

| Digital Marketing Malaysia | Marketing-focused | Good for growth tactics |

| Founders in Malaysia | Founders specifically | Smaller, more focused |

| Remote Workers & Freelancers Malaysia | Remote/indie | Good if you're solo |

Slack & Discord Communities

- Startup Malaysia Slack — Search for invites on LinkedIn or ask around at events

- Various tech-specific Discords — Depending on your stack (Web3, AI, etc.)

Co-Working Space Communities

Don't underestimate the community at your Malaysia Digital Hub. These spaces often host events, workshops, and informal gatherings. Make an effort to actually be present and talk to people — some of the best connections happen over coffee in shared kitchens.

If you're in a co-working space like:

- Common Ground — Regular member events, good networking

- WORQ — Strong startup community, founder-focused events

- Co-labs — Community events and workshops

- Colony — More corporate, but good for B2B connections

Actually show up. Work from the common areas sometimes instead of hiding in a private room. Say yes to the events, even when you're busy.

Ecosystem Organizations

MaGIC (Malaysian Global Innovation & Creativity Centre)

Government-backed startup ecosystem builder. They run programs, events, and have a community of founders. Worth following and attending their events.

Cradle Fund is a government agency focused on startup funding and support. They run grants and programs, and have a community around their portfolio companies.

Accelerator program with a strong alumni network. Even if you don't go through their program, their events are often open to the broader community.

Industry-Specific Communities

Depending on your sector, there may be specific communities worth tapping into:

- FinTech — FinTech Association of Malaysia, FinTech Malaysia Facebook group

- HealthTech — MHTC (Malaysia Healthcare Travel Council) ecosystem

- E-commerce — Various Shopee/Lazada seller communities

- Web3/Crypto — Active Telegram and Discord groups (search by specific interest)

- AI/ML — Malaysia AI community on Facebook, various Meetup groups

Events & Meetups

Get out and meet people in person. Some regular events to look out for:

- Startup Grind KL — Part of the global Startup Grind network, regular events

- Tech in Asia — Regional tech conferences, sometimes in KL

- Wild Digital — Major regional startup conference

- Echelon — Another major regional event

- Meetup.com — Search for tech, startup, and entrepreneur meetups in KL

Expat & Social Communities

Building a life here isn't just about work. It helps to have a social network too:

- InterNations — Large expat community, regular events

- Meetup groups — Hiking, sports, hobbies, languages

- Facebook expat groups — "Expats in KL", "Expats in Malaysia", etc.

- Sports clubs — Hash House Harriers (running), various football/basketball groups

- Country-specific groups — Dutch in Malaysia, French in KL, etc.

The Foundingbird Community

Shameless plug: we're building a community of MTEP entrepreneurs and founders in Malaysia through Foundingbird. Our clients get access to our network, introductions, and regular knowledge-sharing.

If you're working with us on your MTEP application, incorporation, or ongoing services, you'll automatically be part of this community. We try to connect founders who can help each other — whether that's sharing experiences, making referrals, or just grabbing coffee.

Join the Foundingbird community →

14. Case Studies and Success Stories

[Coming Soon]

15. A Comparison Against Other Countries

One of the most common questions I get is: "Why Malaysia over Singapore/Thailand/elsewhere?" It's a fair question. Let me give you an honest comparison.

Singapore

Let's address the elephant in the room first. Singapore is often the default choice for startups in Southeast Asia, and for good reason. But it's not the right choice for everyone.

Singapore Pros:

- Stronger brand recognition globally

- More established VC ecosystem

- Easy access to banking and financial services

- Strong rule of law and IP protection

- Gateway to regional markets

- English as primary business language

Singapore Cons:

- Very expensive (rent, salaries, everything)

- Harder to get entrepreneur visas (EntrePass has strict requirements)

- Small domestic market

- High burn rate means runway evaporates faster

- Increasingly competitive for talent

Malaysia (MTEP) vs Singapore (EntrePass):

| Factor | Malaysia (MTEP) | Singapore (EntrePass) |

|---|---|---|

| Visa difficulty | Moderate | Harder (stricter requirements) |

| Cost of living | Low-moderate | Very high |

| Monthly burn (solo founder) | MYR 5,000 - 10,000 | SGD 5,000 - 10,000 (3x more) |

| Office/co-working costs | Lower | Much higher |

| Developer salaries | Lower (30-50% less) | Higher |

| Banking ease | Challenging but doable | Easier |

| Investor access | Growing | More established |

| Regional HQ perception | Good | Premium |

The Malaysia-Singapore Combo:

A common setup I see:

- Singapore holding company (for investor-friendliness, banking, brand)

- Malaysian operating company (for actual operations, team, cost efficiency)

- Founder lives in Malaysia (better quality of life, lower costs)

This gives you the best of both worlds, though it adds complexity and cost. Worth considering once you're at a certain scale.

Thailand

Thailand is increasingly popular with digital nomads and entrepreneurs. Here's how it stacks up:

Thailand Pros:

- Very low cost of living (even cheaper than Malaysia outside Bangkok)

- Great lifestyle (beaches, food, culture)

- Growing startup ecosystem (especially Bangkok)

- Long-Term Resident (LTR) visa now available

- Strong tourism infrastructure

Thailand Cons:

- More challenging visa options historically (though improving)

- Difficult for foreign ownership

- Thai language barrier (less English in business)

- Banking can be very difficult for foreigners

- Less developed startup ecosystem than Malaysia

- Political instability (historically)

Malaysia vs Thailand:

| Factor | Malaysia (MTEP) | Thailand (LTR/SMART Visa) |

|---|---|---|

| Visa clarity | Clear program for entrepreneurs | LTR is newer, still evolving |

| English proficiency | High | Lower (except in tourist areas) |

| Cost of living | Low | Very low (outside Bangkok) |

| Banking difficulty | Challenging | Very challenging |

| Startup ecosystem | More developed | Growing but smaller |

| Infrastructure | Strong | Strong in cities |

| Muslim-friendly | Yes (majority Muslim country) | Less so |

| Quality of life | High | High |

Other Countries Worth Considering

Here's a quick look at other options in the region and beyond:

Indonesia

- Huge domestic market (270M+ people)

- Challenging visa/company setup for foreigners

- Growing startup ecosystem (largest in SEA)

- Best if you're specifically targeting the Indonesian market

Vietnam

- Low costs, young population

- Growing tech scene (especially Ho Chi Minh City)

- Visa options for entrepreneurs are limited

- Good for certain industries (manufacturing, outsourcing)

Philippines

- English-speaking population

- Lower costs

- Startup ecosystem still developing

- PEZA zones offer some benefits

Dubai/UAE

- Tax-free (0% personal and corporate)

- Growing startup ecosystem

- Higher cost of living

- Good for certain markets (MENA, Africa)

- Various free zone options

Portugal

- Popular with European founders

- Startup visa available

- EU access

- Growing but small ecosystem

- Good quality of life

Estonia

- e-Residency program

- Easy company formation

- EU access

- But you can't actually live there on e-Residency

- Good for holding company structure

The Honest Assessment

Here's my honest take on when Malaysia makes sense:

Malaysia is a good choice if you:

- Are bootstrapping or have limited runway

- Want a good quality of life at reasonable cost

- Are targeting Southeast Asian markets

- Want a clear visa pathway for entrepreneurs

- Value English-speaking business environment

- Don't need the "Singapore brand" (yet)

- Want to build a local team cost-effectively

Malaysia might not be the best choice if you:

- Need the prestige of a Singapore or US address for investors/clients

- Are targeting China specifically (consider Hong Kong)

- Need very easy banking from day one

- Are building a business that requires specific regulatory environments

Get Started with MTEP

Ready to begin your MTEP journey? Contact Foundingbird today for a consultation. We can help you:

- Determine if your business qualifies for MTEP

- Prepare your application and pitch deck

- Connect you with Malaysia Digital Hubs

- Incorporate your company in Malaysia

- Set up banking, compliance, and ongoing business support

This guide is maintained by Dylan Damsma, Founder & CEO of Foundingbird. For questions or updates, please contact us at foundingbird.com.

Table of Contents

We're the most convenient online platform for starting & managing a Sdn Bhd

- Incorporation of Sdn Bhd

- Company secretary

- Accounting & Bookkeeping

- Audit & Taxation

- HR & Payroll

Frequently Asked Questions

What is MTEP Malaysia?

The Malaysia Tech Entrepreneurship Program (MTEP) is a visa program by MDEC designed to attract tech and startup entrepreneurs to build their business in Malaysia. It offers two tracks: New Tech Entrepreneur (1-year PVP) and Experienced Tech Entrepreneur (5-year Residence Pass).

How long does the MTEP application process take?

The MTEP application process typically takes 6-10 weeks from document preparation to visa issuance, including 1-2 weeks for documents, 2-4 weeks for application review, 1-2 weeks for the pitch invitation, 1-2 weeks for the final decision, and 1-2 weeks for visa issuance.

What are the requirements for MTEP visa?

MTEP requires you to be developing proprietary technology (software or hardware), proof of funds (minimum RM50,000 balance over 3 months), a pitch deck, passport valid for 18+ months, and for New Entrepreneurs, a Malaysia Digital Hub agreement.

Can I bring my family on MTEP visa?

Only Experienced Tech Entrepreneurs on the 5-year Residence Pass can bring dependents (spouse and children, who are allowed to work). New Tech Entrepreneurs on the 1-year Professional Visit Pass cannot bring dependents.

How much does MTEP visa cost?

New Tech Entrepreneur (PVP) costs approximately MYR 4,000-4,700 total including application fees, personal bond, and visa endorsement. Experienced Tech Entrepreneur (RP) costs approximately MYR 6,000-6,700 total.

What is the difference between MTEP and DE Rantau Digital Nomad Visa?

MTEP is for entrepreneurs starting their own tech business in Malaysia, while DE Rantau is for remote workers and freelancers working for overseas clients or employers. MTEP allows you to incorporate and run a Malaysian company; DE Rantau does not permit working for Malaysian companies.

Can foreigners own 100% of a Malaysian company under MTEP?

Yes, foreigners can own 100% of a Malaysian Sdn Bhd (private limited company). The only requirement is that at least one director must ordinarily reside in Malaysia, which MTEP visa holders fulfill.

What industries qualify for MTEP?

MTEP covers tech entrepreneurs developing proprietary technology in sectors including AgriTech, HealthTech, FinTech, Cybersecurity, Smart Cities, Mobility, AI and Robotics, Blockchain, Big Data, and Drone Technology. The key requirement is proprietary software or hardware development.

Need More Help?

Explore our other guides or get in touch with our team.